3.3 The steps required to reach a determination for the purposes of the National Accounts

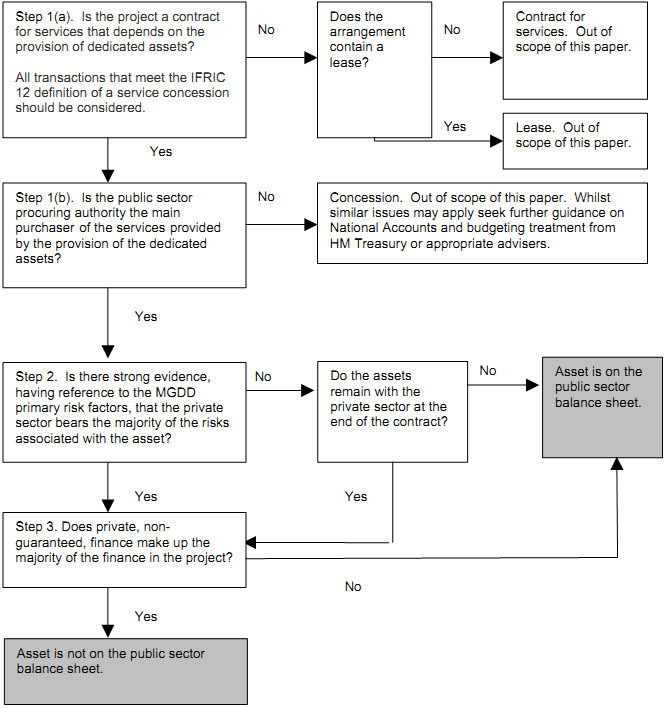

This section of the paper sets out the steps required in order to reach a National Accounts determination, and explains the linkage to the process undertaken for the production of the financial statements of individual public sector bodies. It is essential that this process is carried out in a rigorous and robust manner and that the analysis is clearly documented with supporting evidence. Figure 2 contains a flowchart that sets out the steps to be followed in reaching a conclusion on the National Accounts balance sheet determination.

Step 1. Is the project within scope?

As set out in section 3.1, the guidance contained within this paper is applicable to those private to public arrangements that (i) require the private sector to provide services to the public sector that require dedicated assets in order to deliver those services; and (ii) which are not directly majority funded by end-users of the assets that underlie the transaction through user charges. Therefore there are two sub-steps to consider.

Step 1(a). Is the project a contract for services that depends on the provision of dedicated assets?

For practical purposes, and as set out in section 3.1, where a procuring authority is required to consider the provisions of IFRIC 12 Service Concession Arrangements (as it is to be applied to the public sector grantor of a service concession arrangement as defined within the FReM and supplementary clarification guidance it will be necessary to consider the guidance contained within this paper in order to make the balance sheet determination for the purposes of the National Accounts.

Step 1(b). Is the public sector procuring authority, the end-user or another third party the main purchaser of the services provided by the provision of the dedicated assets?

Having determined that the transaction is of a type that will be assessed under the provisions of IFRIC 12 for the purposes of the presentation of the financial statements (i.e. meets the definition of a service concession arrangement) and so for National Accounts purposes can be considered a contract for services based on the provision of dedicated assets, it is necessary to consider who is purchasing the services being provided.

Where the main purchaser of the services is the end-user of the asset (or another third party), for example the private motorist on a toll road, then the transaction is not directly within the scope of this guidance. In these cases public sector procuring authorities may need to consider similar issues but the project will be outside the direct scope of the guidance contained within this paper. Key issues in these cases are likely to include the sector classification of the entity engaged in the activity and the treatment of any guarantees or other financial underpinning provided by the public sector.

Where the public sector procuring authority is the main purchaser of the services provided by the private sector partner, i.e. it is not a user-pays arrangement, on the basis of the dedicated assets, the transaction continues to remain in scope.

Step 2. Having determined the transaction is within the scope of this guidance, is there strong evidence that the private sector is bearing most of the risk attached to the dedicated assets in question?

The MGDD primary risk factors should initially be assessed in a narrative fashion to establish which party to the transaction is responsible for each risk. Where the MGDD primary risk factors provide a clear indication of the allocation of risks between the parties then there is no need to consider the transaction further and an appropriate judgement can be reached.

Where an individual risk is judged as being shared between the parties the relative significance of all aspects of the MGDD primary risk factors should be considered when deciding if, overall, it is still possible to rely on an analysis of the MGDD primary risk factors. Statistical techniques, including the use of Monte Carlo simulations, can be used to model a range of expected values for the asset related profit and losses associated with the project, in order to determine which party bears the majority of the risks and rewards associated with the assets, having reference to the MGDD primary risk factors.

If, on the basis of the MGDD primary risk factors, it is not possible to conclude, then the presence of residual value risk should be considered.

Step 3. Are the financing arrangements consistent with the analysis?

Before concluding that a transaction is not to be accounted for on the public sector balance sheet, the financing arrangements must be examined. See boxes 2 and 3.

Once a determination has been reached, it is envisaged that it would only be necessary to review the decision if the transaction materially changes, potentially due to renegotiation of key terms of the contract or other external factors, such that the allocation of risks associated with the dedicated assets changes.

Figure 2. Process flowchart

Having concluded on the National Accounts balance sheet determination of the assets that underlie the transaction, it is necessary to consider whether the result of that assessment is such that dual reporting for the purposes of accounts and budgets is required, and this is covered in Section 4.