3.3 Residual Value and Ownership

Taken in tandem, Results 1 and 2 just tell us that bundling at worst weakly dominates unbundling. With a positive externality, bundling raises welfare as it eases the moral hazard problem. With a negative externality and under unbundling, investment a is already at a minimum, the builder having no incentives to invest. Bundling is of no value.

If we were taking only the "agency route" as a justification of PPPs, the results of this simple model would be a little bit too weak: PPPs should always be weakly preferred.

The important issue is thus to find conditions under which unbundling, viewed as a more traditional form of public procurement, may be strictly optimal.18 To do so we will now identify PPP as an organizational form where there is bundling of design and operation phases but also private ownership of the assets over the length of the contract. Traditional contracting corresponds instead to the case where G buys an asset built (and thus initially owned) by the private sector and operates it through a second firm be it private or public.

Ownership of the infrastructure matters to the extent that assets have some residual value for the owner at the end of the contract. Ownership entitles the owner with the market value of these assets. Enjoying this residual value provides incentives to invest in asset quality so that ownership is also a substitute for more complete contracts. Of course, that residual value will depend on assets specificity. Indeed, facilities for the provision of public services are distinguished into two categories: (i) generic facilities, such as leisure centers, office accommodation, general IT systems and land use; and (ii) specific facilities, such as hospitals, prisons and schools. In the case of generic facilities, there is demand from users other than the government, so that the public and private residual value do not differ significantly.

To model these issues, let sa, with s > 0, denote the value of the assets at the end of the contract when these assets are used by the government for public service provision, and let  , with

, with  , denote the corresponding value for private use. Consistently with much of the incomplete contracts literature,19 the residual value of these assets cannot be specified ex ante in a contract although it is ex post observable once realized and can be bargained upon at that date.

, denote the corresponding value for private use. Consistently with much of the incomplete contracts literature,19 the residual value of these assets cannot be specified ex ante in a contract although it is ex post observable once realized and can be bargained upon at that date.  captures the degree of asset specificity, with

captures the degree of asset specificity, with  being higher the less specific is the facility. Since

being higher the less specific is the facility. Since  it is always optimal that the facility be owned by G at the end of the contract. That the asset returns to G at the end of the contract is indeed one of the main features that distinguishes PPP from privatization.

it is always optimal that the facility be owned by G at the end of the contract. That the asset returns to G at the end of the contract is indeed one of the main features that distinguishes PPP from privatization.

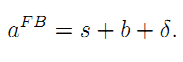

As a benchmark, note that the first-best level of a now solves

18 Actually, one can show that in the context of Section 3.2.2 unbundling dominates for a negative externality.

19 Hart (1995).