3.3.2 Private Ownership

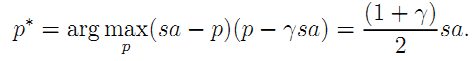

Suppose assets are privately owned. At the end of the contract, efficiency requires to transfer ownership to G. Assuming that, ex post, the price p* at which ownership is transferred results from Nash bargaining with equal bargaining power between G and F:

This yields to the private owner a net benefit  which is increasing in a and boosts his incentives to enhance the quality of the assets if he is a builder.20

which is increasing in a and boosts his incentives to enhance the quality of the assets if he is a builder.20

Note that the owner's incentives to invest is greater when the asset is less specific. InÞed, asset specificity decreases the status quo payoff if ownership is not transferred to the public sector at the end of the contract. This exacerbates the hold-up problem that occurs through ex post bargaining and dampens the private owner's incentives.

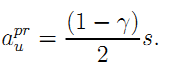

• Private ownership and unbundling: With unbundling and ownership by the builder,

the builder's incentive constraint can be written as:

| (10) |

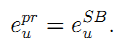

The operator's effort and optimal incentive scheme remain the same as in Section 3.1:

| (11) |

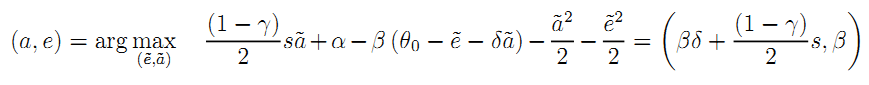

• Private ownership and bundling: Ownership has still some value with bundling.

The consortium's expected payoff is maximized for effort levels that solve:

| (12) |

where s is large enough to insure a positive quality-enhancing effort even with a negative externality.

Comparing public ownership with private ownership, we immediately obtain:

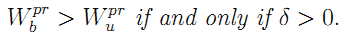

Result 5 Private ownership always dominates public ownership. The gain from private ownership is non-increasing in the level of asset specificity.

Comparing now PPPs and traditional procurement, we get:

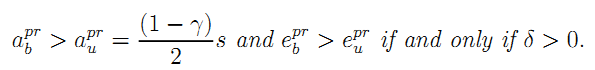

Result 6 PPPs, i.e., Private ownership and bundling, strictly dominates traditional contracting, i.e., private ownership and unbundling, if and only if the externality between the design and the operation phases is positive:

Efforts are greater under bundling if and only if the externality is positive.

Compared to the case of public ownership, bundling leads now to strictly lower efforts than unbundling under private ownership if the externality is negative. Ownership of the asset gives to the builder positive incentives to invest in asset quality These incentives are then depressed if the builder is induced to internalize the negative externality that asset quality exerts on operational cost.

Giving ownership of the infrastructure to the builder reduces the hold-up problem and boosts quality-enhancing effort a (whatever the sign of the externality).21 The builder, when an owner, appropriates part of the surplus from enhancing quality of the infrastructure and the more so the greater the asset specificity (i.e., the higher is  ). Since the value of improving quality is not risky, there is no risk premium associated to private ownership and private ownership is always optimal. Then private ownership is more beneficial for generic facilities, (where

). Since the value of improving quality is not risky, there is no risk premium associated to private ownership and private ownership is always optimal. Then private ownership is more beneficial for generic facilities, (where  is high), such as leisure centers and housing, than for specific facilities such as hospitals, prisons or schools. However, since the contractor never fully internalizes the positive effect on social benefit b, underinvestment in quality always follows. When a higher building quality raises operational cost, bundling is suboptimal as internalization of the externality would depress investment further.

is high), such as leisure centers and housing, than for specific facilities such as hospitals, prisons or schools. However, since the contractor never fully internalizes the positive effect on social benefit b, underinvestment in quality always follows. When a higher building quality raises operational cost, bundling is suboptimal as internalization of the externality would depress investment further.

_____________________________________________________________________________________________________

20 It should be clear that under, unbundling, ownership by the builder is preferable to ownership by the operator since the operator has no control on quality-enhancing effort.

21 However, results may change if a has a negative impact on the market value of the asset, though it still increases the value of the asset when used for public purposes. This is likely to occur for facilities for which the design is very specific to the delivery of the public service. See Rajan and Zingales (1998).