4.1 Optimal Risk Allocation

A critical aspect of any PPP contract is the allocation of demand risk between the government and the contractor. The means through which demand risk is allocated is the payment mechanism. Broadly speaking there are three main payment mechanisms, depending on whether the payment is based on (i) user charges, (ii) usage, or on (iii) availability.23 In a payment mechanism solely based on user charges, the contractor receives its revenues directly through charges on the end users of the infrastructure facility and bears all demand risk. Instead, in a payment mechanism based on usage, the government collects user charges and then makes unitary payments to the contractor. The allocation of demand risk depends on the relationship between the payment and the actual usage level. In a payment mechanism based on availability, the government rewards the contractor for making the service available but the payment is independent of the service actual usage; the government retains all demand risk. In many schemes, the payment to the contractor comprises a combination of the above payment schemes.

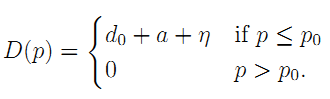

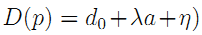

To see the factors that affect the optimal allocation of demand risk and the choice of the payment mechanism, assume that consumers have an inelastic demand for the service up to some price level p0 which is given by:

The random variable η is normally distributed, with zero mean and variance σ2. a is a demand-enhancing effort whose disutility counted in monetary terms is still.

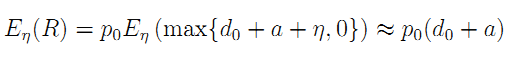

The firm can extract all the consumer's surplus by means of a fixed-fee (for instance a toll in the case of highways). It gets thereby the expected revenue:

where the approximation above holds when σ2 is small enough compared to the base level of demand d0.

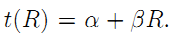

For simplicity, we assume away any incentive problem on the cost side and zero marginal costs of providing the services. With those assumptions, a linear payment mechanism is in full generality a scheme of the form  The fee α is a fixed payment to the firm (or subsidy) paid irrespectively of the revenue generated. The coefficient β is meant for the share of those revenues which are left to the firm. The share 1 - β being left to the government. To fix ideas, a payment mechanism solely based on user charges corresponds to the case α = 0 and β = 1 so that the contractor bears all demand risk and receives no insurance. In a payment mechanism based on availability, α > 0 and β = 0 so that the contractor's reward is fixed and the government retains all demand risk.

The fee α is a fixed payment to the firm (or subsidy) paid irrespectively of the revenue generated. The coefficient β is meant for the share of those revenues which are left to the firm. The share 1 - β being left to the government. To fix ideas, a payment mechanism solely based on user charges corresponds to the case α = 0 and β = 1 so that the contractor bears all demand risk and receives no insurance. In a payment mechanism based on availability, α > 0 and β = 0 so that the contractor's reward is fixed and the government retains all demand risk.

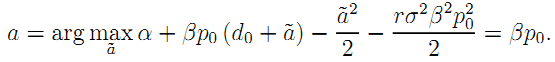

The contractor maximizes the certainty equivalent of his expected utility and his incentive constraint can be written as:

|

| (13) |

From this characterization of the incentive constraint, we get:

Result 7 The optimal payment mechanism comes closer to be based on user charges only when risk-aversion and demand risk are small (high-powered incentives). Instead, the payment mechanism moves towards being based on availability only when risk-aversion and demand uncertainty are large (low-powered incentives).

Transferring demand risk to the contractor gives it incentives to boost demand and raise consumer surplus but it costs the government a higher risk-premium. The optimal payment mechanism trades off incentives and insurance. Further, if we let λ be a scale parameter affecting the impact of a on demand (namely, we have now  , we easily find that both βSB and aSB raise with λ. That is, for PPPs in sectors such as transport, where demand levels are affected by the contractor's action, demand risk should be borne mainly by the contractor. For PPPs in sectors such as prisons, or schools, where usage mainly reflects government policy in the sector, demand risk should be borne mainly by the government.

, we easily find that both βSB and aSB raise with λ. That is, for PPPs in sectors such as transport, where demand levels are affected by the contractor's action, demand risk should be borne mainly by the contractor. For PPPs in sectors such as prisons, or schools, where usage mainly reflects government policy in the sector, demand risk should be borne mainly by the government.

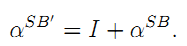

Remark 1: Investment. Suppose that the firm must cover an investment of size I with the revenue of the service. The investment is realized when the fee is increased by the value of the investment:

When fees are available, there is no problem in passing the cost of investment to the government, i.e., to taxpayers. We come back in Section 5 below on the conditions for financing investments when such fees are no longer available.

_____________________________________________________________________________________________________

23 For a more in depth discussion see Iossa, Spagnolo and Vellez (2007). An interesting issue that we do not address concerns political accountability under various contractual forms. In this respect, Athias (2008) compares the performance of concession contracts and availability contracts in terms of their impacts on the incentives of public authorities to respond to customers needs.