The role of equity investors

1.1 Project finance is a form of financing which is provided to a company set up for a single project, including some that develop and build infrastructure projects to deliver public services. Private sector project funding is exposed to project risks and so is more expensive than government borrowing.

1.2 Banks, or bondholders, will provide around 90 per cent of the project funding as debt on condition that the project has been fully developed by investors whose risk capital, known as equity, will be lost first if the project company encounters difficulties. Investors provide most of this risk capital as loans, because loan interest reduces corporation tax and can provide income once operations commence. They provide the remainder as a small, often nominal, amount of share capital.

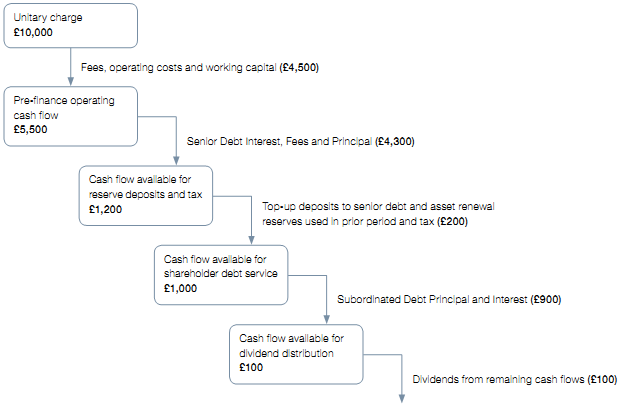

1.3 The banks' and bondholders' debt is known as senior debt because it has first priority for repayment after operating costs have been met (Figure 1 overleaf). Only then can the equity investors claim interest on their loans and any cash surplus in the form of dividends. In return for taking higher levels of risk, investors take a higher rate of return, including remaining cash flows once the project has paid off its third party debt. Their profits are subject to performance and can be higher, or lower, than estimated at the start.

1.4 This section explains the role of equity investors in privately financed government projects, including:

• the relationship between equity investors and other parties involved in a private finance project;

• the different types of investor;

• the contractual arrangements which are generally used to incentivise and reward investors;

• how far the role of equity investors is monitored by the Treasury and authorities; and

• the relationship between risk and reward in assessing the role of equity investors.

| Figure 1 Illustration of the order, and relative size, of payments made by a project company after receiving service charge payments (cash waterfall) |

|

|

| NOTES 1 The public sector makes regular monthly payments known as the unitary charge, taken as £10,000 in this illustration. The example shows that from a £10,000 public sector payment, around £4,500 goes to running the project, £4,300 to the banks and £1,000 to the investors (with £200 added to reserves). 2 The proportion of costs will vary between different types of projects. Source: National Audit Office |