The investors transfer certain operating risks to contractors but retain others

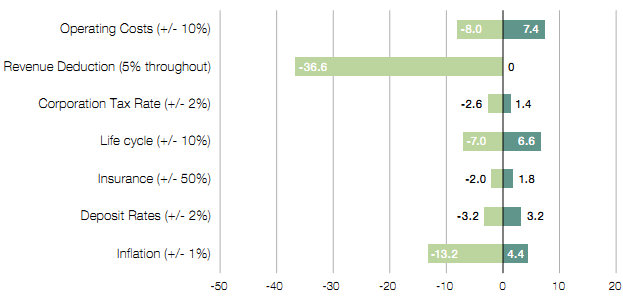

2.10 The main operating risks investors retain are performance failure, increased operating costs (including life-cycle maintenance) and adverse changes in original investment assumptions (including insurance cost and coverage, disputed contract responsibilities, and rates of inflation). Investors usually transfer to contractors most of the cost and performance risks of facilities services, such as building maintenance. However, investors retain the residual risk exposure if the subcontractor defaults or if performance payment deductions are sustained over a long period. This could reduce their rate of return by the percentages shown in Figure 5. In 2011, we conducted a survey of projects in operation under the most recent form of PFI contract (Appendix Two). Most respondents considered it fairly, or very unlikely, that a subcontractor would default, but could not predict the financial consequences were they to do so.

Figure 5 Sensitivity of returns to risks retained during the operational stage |

Percentage |

NOTES 1 The project financial model has been run for the cost increases or decreases shown, which are percentage points for corporation tax, deposit rates and inflation. 2 The revenue deduction of 5 per cent, shown above, is after any recovery from contractor(s). 3 For changed deposit rates, see paragraph 2.8. Life-cyle risk is discussed in paragraph 2.11. 4 Under some contracts, changes in insurance costs may be shared with the Authority. 5 Investors usually have part of the agreed price linked to a price index, but may not be fully protected. Source: Reproduced with permission from HICL Infrastructure Company Limited Report to investors, 23 September 2010 |

2.11 Variance in insurance costs, the costs of maintaining and equipping the building ('life-cycle risk') and contractor credit and performance risk were the three risks most frequently mentioned to us as operating risks retained by the project company and investors. Investors typically also retain other risks of changes in the management and running costs of the project company itself.

2.12 Few, if any projects have yet to reach the stage of major life-cycle spending. Therefore, the probability of material variations in life-cycle costs remains unknown. Most survey respondents considered that if life-cycle costs were 15 per cent higher than expected, the impact on distributions to shareholders would last for five or more years. Higher cost increases could lead to project company insolvency. But life-cycle costs could equally be lower than expected and, if the benefit of lower costs is not shared, investors will realise additional profit.