Meeting lenders' requirements influences equity returns

3.5 Lenders' controls can act to underpin minimum investor returns. The debt agreements between the lenders and the project company specify 'cover ratios' for the minimum amount of cash that the project company must generate to cover its debt service obligations, after paying its operational costs. The required level of cash reserves leads to a higher service charge payment and, if unused, supplement the investors' returns.

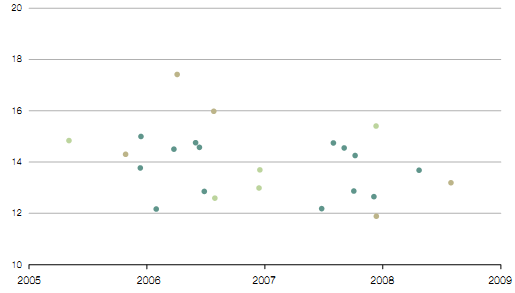

Figure 7 Rates of return in bids for equity at contract award |

Percentage

• Health • Education • Defence |

NOTES 1 Nominal rates of return in financial models are typically given after paying corporation tax. 2 Waste projects are excluded because their equity rates of return reflect risks not found in other types of PFI project. Source: National Audit Office analysis of project financial models in sample of 24 |

3.6 In 18 of the 24 financial models that we examined, there were periods when the cash available was equal to, or no more than, 10 per cent greater than payments due to lenders. Investors had sought revenue to give them a small margin for error in their forecasts. They could go no lower without increasing the risk that even minor project problems would allow lenders to prevent distributions to shareholders, or at worst result in a default under the senior debt arrangements.