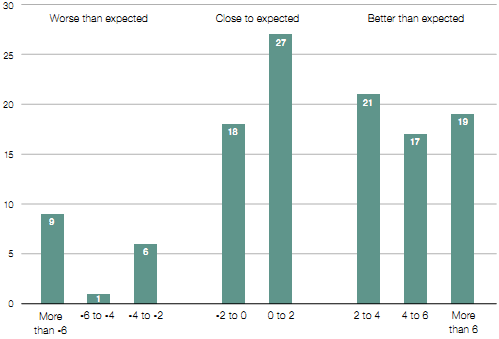

Changes to investors' returns from project performance

3.7 As part of their management of their investments, investors monitor project performance and update their forecast of the return they expect to receive from a project as the project progresses. In autumn 2011, primary investors provided us with information on how the returns they expected to achieve on 118 projects had changed since the contract was awarded. They told us that they were forecasting returns in 84 of these projects that were equal to or exceeded the originally forecast rate of return (Figure 8 overleaf). Investors were forecasting reduced returns in the remaining 34 of the 118 projects.

Figure 8 Variation in forecast project returns |

Number of projects

Variation in percentage points |

NOTE 1 Reported projected returns for PFI projects in operation, but - in almost all cases - not yet at the stage of significant life-cycle expenditure. Depending on such expenditure, and other risks, the reported forecast returns will keep changing. Source: National Audit Office analysis of investor submissions |

3.8 Some of these forecast changes were large. The rate of return had increased by at least four percentage points since the contract was awarded on 36 of the 118 projects, while the forecast return on 10 projects had decreased by over four percentage points. On projects with a planned pre-tax rate of return of 13 per cent, a change of four percentage points would alter the rate of return by around a third. All these projects are in operation, but have yet to reach the stage of significant life-cycle expenditure. Depending on such expenditure, and other risks, future returns will vary.

3.9 Investors expect their return over the life of the project to be volatile. Large debt payments, high fixed costs, and the way that investors receive all the residual cash flow value remaining in the project when it is complete, mean that small changes in the special purpose companies' cash flows can have large effects on the equity returns. Although investors transfer most cost-related risk to their contractors, they remain exposed to a range of risks (paragraphs 2.6-2.12). For example, early or late delivery of construction can lead to large changes in the equity return.