Primary investors returns from sales of equity

3.11 There is an active secondary market for PFI equity. Most sellers are investors whose main business is providing construction or facilities management services, rather than institutional investors. They sell their equity to release their capital, allowing them to bid for new contracts. Institutional investors see more value in earning the original equity post-tax return (12-15 per cent) for 20-25 years, rather than sale proceeds typically equivalent to annualised rates of return of 15 to 30 per cent per year for, say, five or six years.

3.12 The Treasury has not previously required disclosure of sales proceeds. Using data for some 100 projects for which there is publicly available information about sales of equity from 2003 to 2011, we calculated the sellers' rates of return (referred to as 'exit returns') using two methods:

• Valuation on commitment.13 Often investors inject only a small proportion of their promised investment into the project at the start, but commit to providing the rest on demand. In the meantime they substitute the committed amount with debt borrowed from a bank. This loan, known as an equity bridge, is repayable when the construction phase is complete or immediately if problems arise. The valuation on commitment method treats the whole commitment as if it was invested at the outset, as this is when the equity is 'on risk' for delivery of the project. This method is used by many investors to calculate their return.

• Valuation on cash injection. We also calculated the present value of the equity investment at the start of the contract, allowing for investment gains in the period between contract award and the date when the investors paid off the equity bridge loan.14 This approach is the one recommended by Treasury for most purposes when calculating returns to equity in PFI deals.

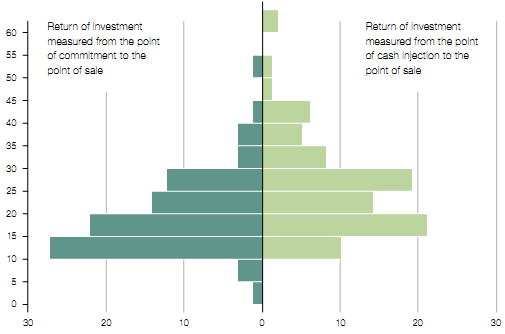

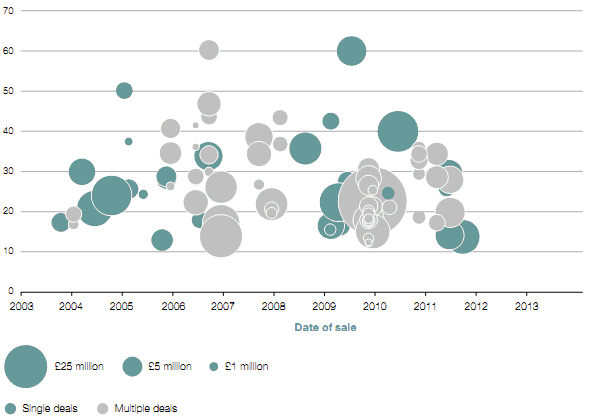

3.13 Using the valuation on cash injection method, our analysis shows that primary investors have typically achieved exit returns of between 15 and 30 per cent when they have sold their shares (Figure 9). The valuation on cash injection method typically measures these exit returns as six to seven percentage points higher than the valuation on commitment method. Depending on the method used, in a few exceptional cases, the exit returns were as high as 40 to 60 per cent, although these were all for deals signed before 2003. Figure 10 shows the distribution of exit returns by size and date of sale, with most of the higher returns coinciding with secondary market investors' prices reaching a peak in 2006-07 (see paragraph 3.20). A few had returns as low as 5 to 10 per cent.

3.14 The main influence on exit returns is the rate of return that purchasers seek to achieve from the project. The future cash flows of the project carry a public sector payment obligation that is attractive to purchasers provided the project has a low operating risk. Project risks reduce once a project reaches operational stability and a secondary investor does not need to recover costs relating to PFI procurement. Also, there is greater certainty over future cash flows when the construction phase is satisfactorily complete.

Figure 9 Estimated exit rates of return | |

Percentage return | Percentage return |

Frequency | |

NOTE 1 We looked at all 200 sets of project company accounts, for which sales had been reported, both at financial close and for the year of the sale. This broadly supports an estimate of the pattern of annualised returns. However, there may be special circumstances affecting specific deals of which we are unaware. Source: National Audit Office analysis | |

Figure 10 Exit rates of return showing the size, and dates, of equity sales |

Percentage

|

NOTES 1 Exit returns are shown, using the valuation on cash injection basis, with the area of each circle denoting (i) the amount of sale proceeds in the year of the sale, for future cash flows that are subject to corporation tax; and (ii) in some cases any amounts of shareholder loan interest received prior to the sale. 2 Project company accounts at financial close, and for the year of sale, have been relied on to identify relevant amounts and dates. Shareholder loans have been acquired as part of the purchase in all but three cases. There may be special circumstances affecting specific deals of which we are unaware. 3 In a multiple sale, the buyer acquires more than one project company from a single seller and sale proceeds have been allocated pro rata to the original amounts invested. Source: National Audit Office analysis of publicly reported data |

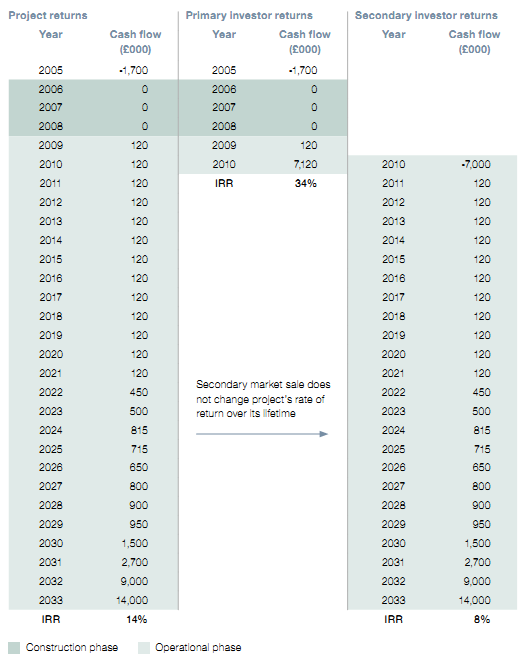

3.15 As a result of this reduced risk, purchasers are often willing to accept a lower rate of return than that originally bid by the primary investor.15 Figure 11 overleaf shows how in an illustrative project (based on an actual project where there had been a sale of PFI equity) this can increase the primary investors' rate of return significantly.

3.16 There are no contractual arrangements for the Government to share in the profits from the sale of PFI equity. PFI investors are, however, subject to UK taxation rules on chargeable gains. Some PFI investment funds have chosen to incorporate outside the UK, for example in Guernsey, but most UK-based shareholders in such a fund will still be liable to capital gains tax. Most foreign investors will be exempt.

Figure 11 Primary investors can achieve high exit rates of return because purchasers are willing to accept lower rates of return than the project's original rate (illustrative sale) |

|

Using the valuation on cash injection method and with unchanged annual cash flows, the seller can generate an exit return of over 30 per cent per year. This is possible because the purchaser has accepted returns six percentage points below the original expected project return. NOTES 1 The initial investment was £1.7 million (including £200,000 in shares and a shareholder loan). 2 The secondary investor pays £7 million for project company shares and income from the shareholder loan. 3 Projected cash flows after 2008 are subordinated loan interest and repayment and dividends. Source: National Audit Office analysis of an illustrative sale |

____________________________________________________________________

13 The date of contract is the date from which investors bear project risks and may have to fund their investment in full.

14 As an indicator of potential investment gains during the bridging period, we discounted the period from commitment to the date of cash injection at the interest rate included in the loan agreement.

15 The overall expected project return is the internal rate of return (IRR) that an investor would earn on the amounts shown in a financial model of the project, prepared when signing the contract.