Secondary investors' returns

3.17 Secondary investors tend to be specialist PFI investment funds, some of which have built up substantial portfolios of PFI investments (Appendix Two). Investors in these funds can include pension funds, which invest in relatively stable long-term projects.

3.18 As with primary equity, efficient secondary market pricing relies on transparent competition and matching prices with comparable investments. All the investors we interviewed considered that the secondary market was indeed competitive. There are few barriers to entry other than having sufficient funds.

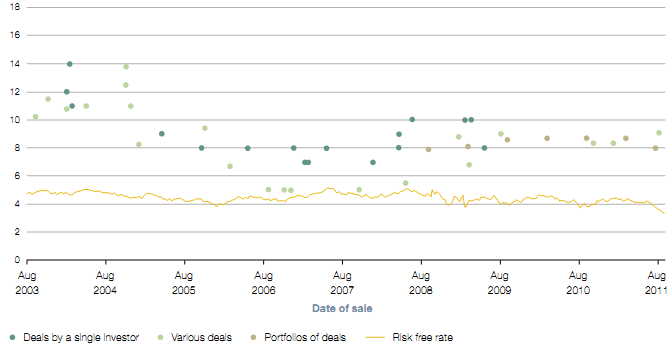

3.19 Figure 12 compares secondary market rates of return with the relatively risk-free rates available from UK government bonds. The annualised rates of return that secondary investors required fell from around 12 per cent in 2003 to just above 7 per cent in 2005. This fall reflected wider market changes, secondary market competition and growing investor understanding of PFI operating risks.

| Figure 12 Reported secondary market rates of return |

| Percentage

|

| NOTES 1 The prices paid reflect the value of future cash flows after paying corporation tax. 2 An investor informed us about a purchase in December 2005 in which the rate of return was 12.1 per cent, which was considerably greater than rates of return linked to other sales in the same month. We did not include this rate of return in the above graph or the analysis in Figure 14 because it was an outlier and we had no knowledge of the project(s) included in the sale. Source: National Audit Office analysis of investor information |

3.20 Returns fell further in 2006-07 to just above 5 per cent, reflecting a period of intense competition by secondary investors.16 Some of these investors borrowed at such low interest rates that they could pay particularly generous prices to primary investors.17 However, low interest loan finance became unavailable during the financial crisis and the reported rates then moved back to earlier levels of around 8 per cent.

_______________________________________________________________________________________________________

16 Some of the cash flows purchased might also have improved, as indicated by Figure 8, which would imply a higher discount rate possibly closer to 7 per cent.

17 The rating agency Standard & Poors (2006) warned: "the infrastructure sector is in danger of suffering from the dual curse of overvaluation and excessive leverage - the classic symptoms of an asset bubble similar to the dotcom era of the last decade".