2 Delivery Strategy

2.1 The VfM programme is designed to ensure that Treasury Group delivers its DSO commitments whilst making the necessary savings. Each member of Treasury Group has developed a VfM delivery plan that outline their contribution to the VfM Programme and how their savings will be achieved. The distribution of funds will be reviewed each year in line with need, reflecting on progress on the transformation plans and other emerging priorities.

2.2 The VfM programme is built on an analysis of how the Group's resources (capital, financial and human) are deployed. The outcome from this analysis has helped identify areas where reductions and economies of scale, that do not affect the Group's outputs, can be made. Excellent progress in the implementation of the Group's VfM programme has already been made. It is expected that the early progress will enable VfM savings from the outset of the CSR period. Actions already taken include:

• Publication of Transforming Government Procurement, which outlines the future role of OGC;

• The transfer and rationalisation of OGC corporate service staff and budgets into a Group Shared Service operation under a single Director of Finance, Procurement and Operations;

• Co-location of OGC's London base with HM Treasury;

• Rationalisation of core Treasury's directorate structure to achieve synergies and deliver economies of scale; and

• The completion of the first phase of the DMO's major systems upgrade.

2.3 Over the CSR period, OGCbuying.solutions have been set a challenging target to improve their Return on Capital Employed. As a trading fund, the savings made by OGCbuying.solutions to achieve this target will be monitored, but do not form part of Treasury Group's VfM programme.

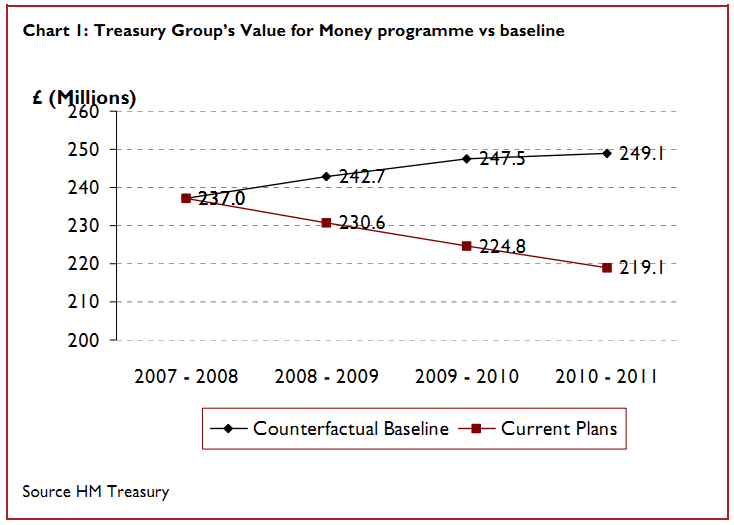

2.4 Compared to the 2007 - 2008 baseline, the programme is projected to achieve overall savings of £30 million recurrently by 2010 - 2011. Table 1 shows the indicative trajectories for the Groups VfM savings over the CSR period.

Table 1: Value for Money Savings

| £ million | 2008 - 2009 | 2009 - 2010 | 2010 - 2011 | Nominal saving per annum |

| HM Treasury Group | 12 | 23 | 30 | 4.12% |

2.5 The minimum projected savings have been calculated as the difference between the post-VfM programme expenditure and counterfactual expenditure, for near cash resource DEL plus capital DEL. The counterfactual expenditure is based on a 'do nothing' scenario of baseline costs increasing by general inflation. Chart 1 outlines the post-VfM programme expenditure against the counterfactual baseline.

2 This figure is consistent with the cross-Government aim to achieve at best 3% net cash releasing savings over the CSR period.