The history of the National Audit Office and private finance

1990 to 1999: the first use of private finance

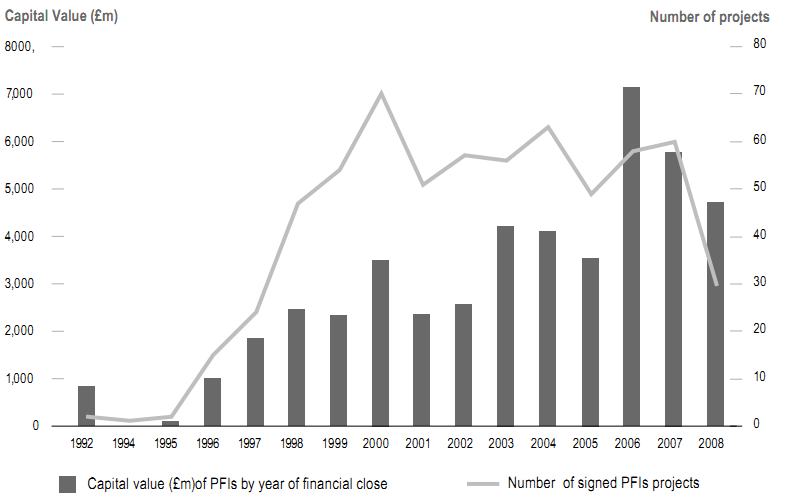

1.8 The Conservative Government started to promote the use of private finance from the beginning of the 1990s. It launched the PFI in 1992 with the aim of promoting public-private partnerships at a national and local level. Yet it took time for PFI to gain momentum, and less than a billion of capital investment had been agreed with private companies by the end of 1995 (Figure 2).

1.9 After the 1997 General Election, the new Labour Government endorsed PFI. Departments started putting forward a number of large projects to use private finance. For example, in 1998 the Department of Social Security transferred the ownership and management of almost all its estate to a private sector consortium, as part of a single PPP deal known as PRIME, which is worth over £1 billion.

| Figure 2 |

|

|

| Source: HMT signed PFI projects database (http://www.hm-treasurygov.uk/ppp_pfi_stats.htm) |

1.10 The National Audit Office followed the development of private finance closely throughout this period and developed a strategy of investigating as many projects as possible as soon as their contracts were signed. Drawing on our first eight reports, in 1999 we published Examining the value for money of deals under the PFI.6 It sets our approach towards the audit of PFIs and PPPs, and provides a framework for how public bodies can maximise their VFM by focusing on our pillars: specifying the project; planning the procurement; running the competition; and completing the contract. Subsequently the Treasury drew upon the report heavily in developing value for money guidance for PFI projects.

2000 to 2005: the increased use of Private Finance

1.11 The period 2000 to 2005 saw a rapid expansion of PFI. Private finance became the main delivery method for new buildings in some sectors within both local and central Government. The private finance sector began to mature, with greater guidance and support from Departments. Partnerships UK was established in 2000, to help develop the Government's PPP policy, support PPP projects and advise on the approval of PFI funding. It helped the Treasury to develop standardised contracts for PFI, now in their fourth generation. Departments set up Private Finance Units, to manage their programmes of PPPs, engage with the private market and establish guidelines for each sector. Local Partnerships (formerly 4Ps) was established to provide support to local authority projects.

1.12 The NAO continued to investigate major deals such as the PPP deals signed by London Underground with Metronet and Tube Lines. We also started to look at thematic issues in the delivery of PFI projects, such as managing relationships between contract managers and contractors,7 construction performance,8 and refinancing.9

2006 to present: focusing on operational projects

1.13 While the capital value of PFI projects has remained very high, there has been a declining trend in the annual value of new deals from 2007. There is little planned new use of private finance in some sectors, such as the hospitals building programme. On the other hand other sectors are starting to emerge, such the increasing number of schools, waste treatment centres and social housing projects.10 By 2009, some 567 PFI projects are in operation with the asset fully constructed.

1.14 During the last three years we have shifted our focus to the operational stage of PFI projects. In 2006, we updated our four pillars approach with a new framework that spanned all the phases of the project and gave more attention to the operational aspects of projects.11 We published a series of reports looking at specific operational issues, including tendering,12 benchmarking and market testing,13 and making changes.14 We have also started to focus more on the way each department is managing its portfolio of private finance projects, reporting on the role of Departments in, for example, the allocation and management of risks in defence projects, the management of the waste PFI programme and the Building Schools for the Future programme.

1.15 We discuss developments in the use of private finance since the credit crunch in part two.

_____________________________________________________________________________________________________________

6 Examining the value for money of deals under the PFI, National Audit Office (HC 739, 1998-99).

8 PFI Construction performance, National Audit Office (HC 371, 2002-03).

9 The refinancing of the Fazakerley PFI prison contract, National Audit Office (HC 584, 1999-2000); The refinancing of the Norfolk and Norwich PFI Hospital: how the deal can be viewed in the light of the refinancing, National Audit Office (HC 78, 2005-06); Update on PFI debt refinancing and the PFI equity market, National Audit Office (HC 1040, 2005-06).

10 Building Schools for the Future: renewing the secondary school estate, National Audit Office (HC 135, 2008-09); Department for Environment, Food and Rural Affairs: managing the waste PFI programme National Audit Office (HC 66, 2008-09).

11 A framework for evaluating the implementation of PFI projects, National Audit Office (2006).

12 Improving the PFI tendering process, National Audit Office (HC 149, 2006-07).

13 Benchmarking and market testing the ongoing services component of PFI projects, National Audit Office (HC 453, 2006-07).

14 Making changes in operational PFI projects, National Audit Office (HC 205, 2007-08).