Supplementary memorandum by Ms Kate Mingay, Department for Transport

PENSION FUND MONEY ACCESSIBLE TO THE UK PFI MARKET

At the 15 December 2009 House of Lords Select Committee on Economic Affairs interview on Private Finance Projects and Off-Balance Sheet Debt, Lord Lipsey asked me to provide a note on the scale of pension fund money coming into PFI projects.

The potential is clearly high, with a 2009 OECD report1 estimating US$500 billion worldwide available for infrastructure investment from pension funds if only 3% of the US$16.2 trillion held by pension funds could be accessed for infrastructure investment.

However, I am not aware of any comprehensive monitoring of the scale of pension fund activity in the UK PFI market. An indicator is the number of equity investment funds involved in UK PFI projects, each of which typically count a number of pension funds among their investors. Of just over 600 signed PFI projects, equity investment funds or their equivalent hold equity in approximately 250 of them, roughly 40%.2 Whilst the proportion of the funds' investment that comes from pension funds is difficult to determine, the vehicle through which pension funds can become involved in the secondary PFI market is well established.

Pension fund investment occurs at two market stages, the primary, following contract signature, and the secondary, once the core construction period has been completed and the contract's risk profile has changed:

- Primary market: indirect investment through PPP funds such as Barclay Private Equity (BPE), Innisfree, Dutch Infrastructure Fund and Equitix.

- Secondary market: indirect investment through PPP funds as above, and on a joint venture/fund basis into fully-invested funds such as Semperian and HBOS PPP funds.

A closer look at secondary market transactions over recent years gives a flavour of the scale of investment. It is important to note that these transactions are not solely backed by pension funds, but include other institutional funds so the figures provide an estimate only.

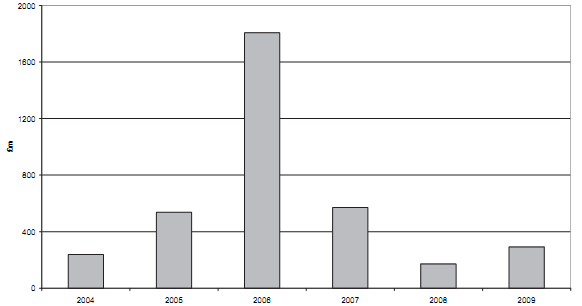

The following chart estimates the amount of primary assets acquired in the secondary market, excluding sales from one secondary buyer to another (eg sale of Land Securities Trillium assets to Semperian), and co-investment transactions at financial close.

Estimated historic secondary sales in UK

Source: UBS estimates, February 2010

2006 includes the large HICL (£250 million) and BBPP (£300 million) funds and Henderson's acquisition of John Laing (£540 million).

The level of investment dropped significantly due to the recent financial crisis and the consequent slow down in transactions across all sectors.

The issue is how to incentivise PPP funds to return to the market, and, more challengingly, how to increase the level of pension fund participation within these investment funds to realise the significant potential of pension funds.

There is some indication that pension fund money is being raised in new infrastructure funds and the trend of pension funds allocating funds into infrastructure (which includes PFI/PPP) will endure.

I have identified a selection of recent pension fund-related UK market transactions:

1. In February 3i Infrastructure, an investor body partially funded by pension funds, acquired a 49.9% (£39 million) stake in Elgin Infrastructure Limited, whose portfolio consists of 16 education and healthcare PFIs.

2. In January this year Lend Lease began raising £120 million of investments using its existing UK and Ireland PFI portfolio to attract pension fund investors, among others.

3. As an example of how pension funds tend to get involved in the secondary PFI market (ie once the core construction period has been completed), in December 2009 the Innisfree private equity fund acquired stakes in schools and defence PFIs:

(a) The construction firm Kier Group sold its stake in two schools PFIs for £7.3 million to Innisfree PFI Secondary Fund.

(b) Carillion sold 65% of its 50% holding in the MoD Allenby Connaught accommodation PFI and half its 40% share in the GCHQ PFI to Innisfree for £86.9 million.

So whilst putting a figure to the scale of pension funds being invested into UK PFI is problematic, the trend for pension fund equity holding in the secondary PFI market is well established.

Separately, I am aware that the Treasury, through Infrastructure UK, is working closely with infrastructure developers and funders to look at ways of stimulating increased private sector investment and unlocking new sources of private capital-including pension fund money-to invest in UK infrastructure.

February 2010

_____________________________________________________________________________________________________________

1 G Inderst, "Pension Fund Investment in Infrastructure", OECD Working Paper on Insurance and Private Pensions, January 2009.

2 Figures derived from September 2009 HM Treasury PFI Equity Holders' List at http://www.hm-treasury.gov.uk/ppp_pfi_stats.htm