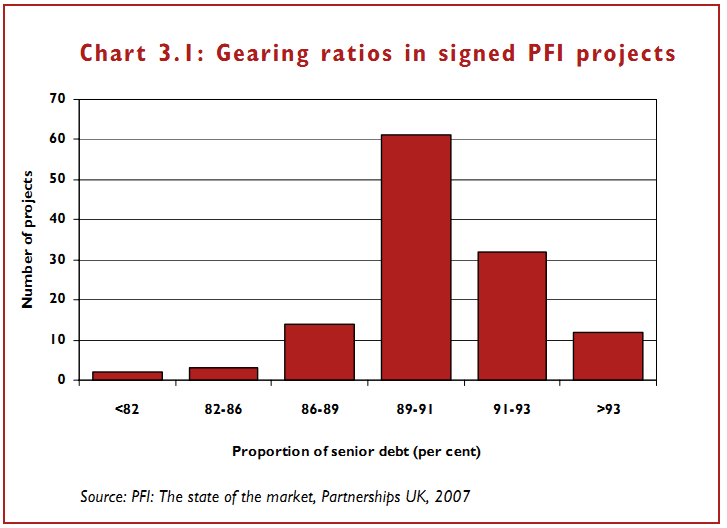

Debt-equity ratios

3.9 Generally, companies facing higher sets of risk require a greater percentage of equity in their capitalisation. In PFI arrangements, the ratio of debt to equity in the SPV's capital structure has tended to be approximately 90 per cent to 10 per cent (see Chart 3.1); these high debt-equity ratios have largely been driven by competitive pressures. Since debt is generally cheaper than equity, highly geared SPV capital structures tend to allow bidders to offer lower unitary charges to the public sector authorities, with risk mitigated primarily through the subcontracting arrangements.

3.10 In some of the emerging PPP contracting structures, as set out in Chapter 2, where, unlike a typical PFI project, risk cannot be fully apportioned through the subcontracting structure at the outset, lenders may need to find alternative means of assuring themselves that their loans can be serviced. In such instances they may seek comfort through a lower debt-equity ratio or they may seek, in negotiating the contract, to pass some of their perceived risk back to the public sector. Procuring authorities need to be alert, when negotiating contracts which are different to SoPC4, to attempts to push risk back to the public sector in the more fluid situations that emerging PPP models may present.