What is Private Finance Initiative (PFI)?

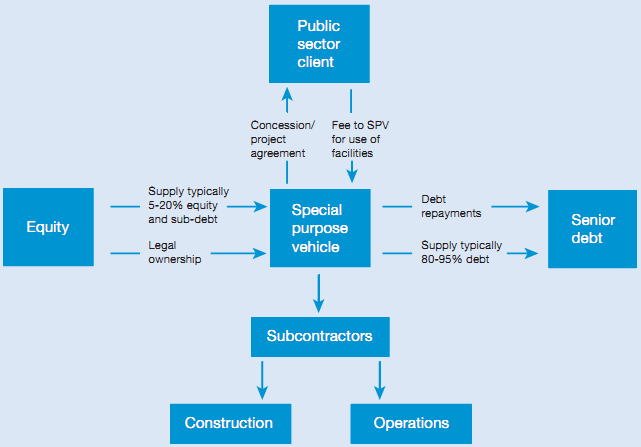

Private Finance Initiative projects are the most common form of Public Private Partnership (PPP) in the UK. They are strictly defined legal contracts, involving private companies in the provision of public services. While they were introduced under the Conservative Government in 1992, PFIs have become more popular since 1996, under the Labour Government. They are now used to provide services in many areas including health, transport, defence and housing. Under a PFI scheme, a capital project is designed, built, financed and managed by a private sector consortium under a contract lasting typically 25 to 30 years. The public sector body pays the consortium a regular stream of payments (usually referred to as a unitary charge) for the life of the contract, after which the assets may revert to being owned by the public sector body. By 2001-02, PFI accounted for 9% of public investment.

PFI is distinguished from other contracting techniques for capital projects by a number of features:

• The contractor is paid based on the ongoing performance of the project over its life, as opposed to the traditional procurement model where costs are paid during and immediately following construction.

• The transfer of risk to the contractor is usually greater than for traditional contracting.

• Responsibility for delivering all aspects of design, construction, maintenance and operation are centralised with the contractor.