1990 to 1999: the first use of private finance

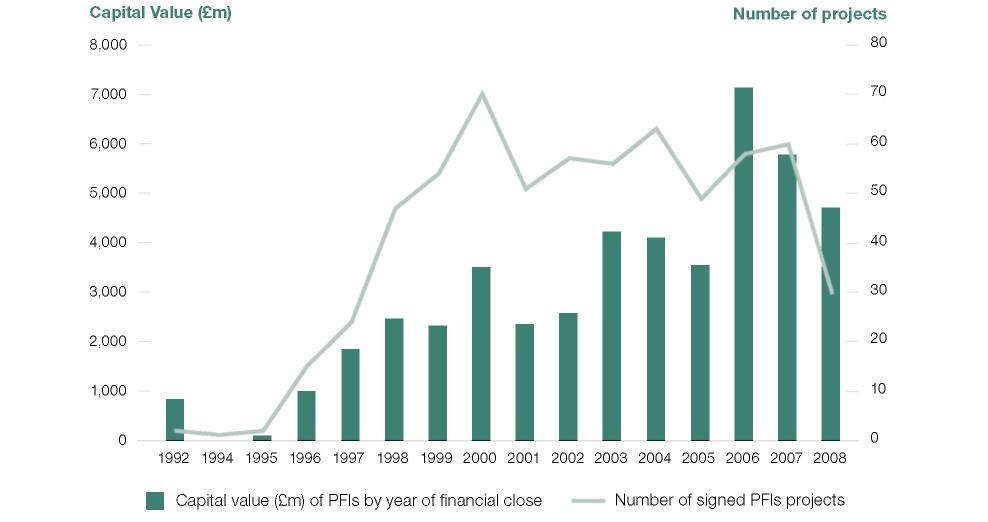

1.8 The Conservative Government started to promote the use of private finance from the beginning of the 1990s. It launched the PFI in 1992 with the aim of promoting public-private partnerships at a national and local level. Yet it took time for PFI to gain momentum, and less than a billion of capital investment had been agreed with private companies by the end of 1995 (Figure 2).

1.9 After the 1997 General Election, the new Labour Government endorsed PFI. Departments started putting forward a number of large projects to use private finance. For example, in 1998 the Department of Social Security transferred the ownership and management of almost all its estate to a private sector consortium, as part of a single PPP deal known as PRIME, which is worth over £1 billion.

Figure 2 The growth of PFI projects (excludes the London Underground PPPs) |

|

Source: HMT signed PFI projects database (http://www.hm-treasury.gov.uk/ppp_pfi_stats.htm) |

1.10 The National Audit Office followed the development of private finance closely throughout this period and developed a strategy of investigating as many projects as possible as soon as their contracts were signed. Drawing on our first eight reports, in 1999 we published Examining the value for money of deals under the PFI.6 It sets our approach towards the audit of PFIs and PPPs, and provides a framework for how public bodies can maximise their VFM by focusing on our pillars: specifying the project; planning the procurement; running the competition; and completing the contract. Subsequently the Treasury drew upon the report heavily in developing value for money guidance for PFI projects.

__________________________________________________________________________________

6 Examining the value for money of deals under the PFI, National Audit Office (HC 739, 1998-99).