Up to april 2009, private finance was often off-balance sheet and not recorded in Government borrowing statistics

3.1 The majority of PPPs involve borrowing that is not included in the Government's statistic of public borrowing, Public Sector Net Debt. The Treasury, however, states that whether or not a project is included in the Government's statistics of public borrowing is irrelevant to deciding on the form of procurement.

3.2 Treasury guidance says that authorities should choose the procurement route based on VFM grounds alone, subject to affordability.43 It provides guidance on how to assess VFM and requires all projects to ascertain that private finance is the best delivery mechanism before using it.

3.3 But for many projects, the public authority feels it has no choice but to use private finance and shape the project to ensure that it is off-balance sheet (i.e. ensure the asset and borrowing are not recorded in its accounts).

3.4 The rules used by statisticians to determine how PFIs are included in Government economic statistics (National Accounts) are compatible with UK Generally Accepted Accounting Practice (UK GAAP), used up to April 2009 by accountants to put together public sector financial accounts. Up to April 2009, a project was recorded the same way in both the public authority's financial accounts and the National Accounts.

3.5 UK GAAP included the liabilities if the balance of risk and reward was with the public sector, and excluded it if the balance of risk and award was deemed to be with the private sector. Interpreting the balance of risk and award was left to individual public bodies and their auditors. The National Audit Office agrees the accounting treatment of central Government projects, while other auditors agree the treatment of local Government and local health sector projects.

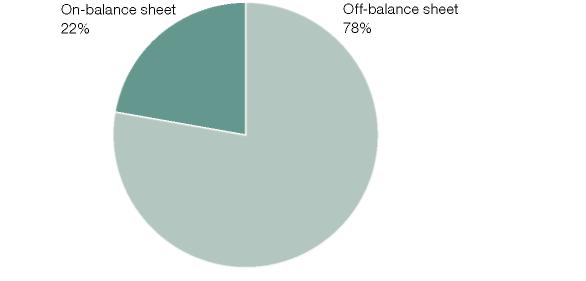

3.6 Seventy eight per cent (£22 billion) of operational PFIs in England by capital value are not recorded on the balance sheet of public sector financial accounts and thus excluded from the Public Sector Net Debt statistics part of the National Accounts. Only 22 per cent (£6 billion) are on-balance sheet (Figure 4). This excludes the London Underground PPPs, which before the failure of Metronet had a capital value of about £18 billion and were on-balance sheet, but are not pure PFI contracts.

3.7 From September 2006, the Office for National Statistics has included the on-balance sheet finance lease liabilities in Public Sector Net Debt. This is mainly PFI and amounted to £4.92 billion when it was first incorporated, increasing the total Government debt by one per cent.44

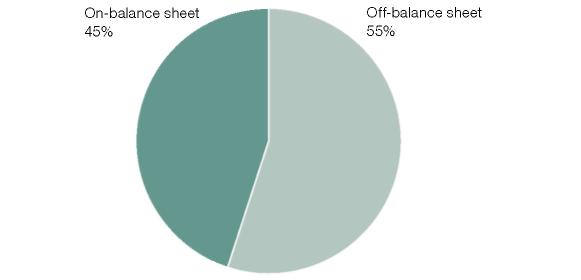

3.8 About half (45 per cent) of projects by capital value audited by the National Audit Office are on-balance sheet. The NAO assesses each project on its own merits against Financial Reporting Standards. We often found that the Financial Reporting Standards require that the liabilities be reflected in the Accounts, mainly because of the balance of residual value and demand risk. Such disclosure not only meets the Financial Reporting principle of reporting substance over form, but also provides transparency over liabilities.

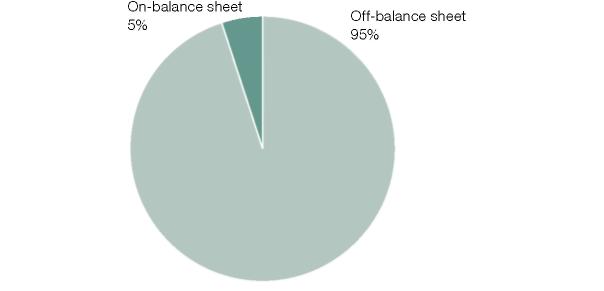

3.9 On the other hand, 95 per cent of local authority PFI projects by capital value were off-balance sheet. The Comptroller and Auditor General reported concerns about the inconsistency in accounting treatment of PFI in his annual general report on financial reporting and auditing every year since 2003 until the introduction of International Financial Reporting Standards in 2009. The National Audit Office's interpretation of both UK GAAP and IFRS would disclose PFI hospitals, schools and many other local authority projects on the balance sheet.45

Figure 4 |

Balance sheet treatment of all operational PFI projects |

|

Local government |

|

Central Government |

|

Source: National Audit Office's calculations from HMT's signed PFI projects database |

__________________________________________________________________________________

43 see for example PFI: meeting the investment challenge, HMT (2003); Value for money assessment guidance, HMT (2006).

44 Adrian Chesson and fenella Maitland-smith, 'including finance lease liabilities in public sector net debt: Pfi and other', Economic Trends, Volume 636, Office for National statistics (November 2006).

45 Financial Auditing and Reporting: General Report of the Comptroller and Auditor General, National Audit Office (HC 335-XiX, 2001-02; HC 517, 2002-03; HC 365, 2003-04; HC 366, 2004-05; HC 1015, 2005-06; and HC 148, 2006-07).