The current situation

The situation in early 2009 is that new, larger projects are finding it difficult to raise finance from the private sector. The practical limit for private sector bank debt in Australia for a PPP project currently appears to be no more than $1 billion, though possibly a little more for the highest profile projects that attract international interest. Projects with a low profile might only attract $500 million or less. (Some large, legacy projects have been financed, but only because moral commitments made by banks at earlier dates have been honoured.) Further, all but the smallest projects require a club of banks. It is also likely that any successful financing of a PPP project will need to include at least one of the 'Big Four' Australian banks, preferably more, as other banks have restricted their activities in the Australian PPP market.

Banks remain unwilling to commit to lending terms for anything other than a short period. In the past, banks were often willing to commit to margins, fees and other lending terms for periods of 6 months or more. Currently, commitment periods are substantially shorter, if they exist at all. Market flex provisions, which allow the banks to revise their terms under certain conditions, are now standard once again, as they were prior to the very buoyant credit market in the few years up to 2007.

Debt tenors available in Australia have shortened further, with up to 5 years now being the norm, under a mini-perm structure where most or all of the debt is repayable at the end of the debt tenor2. The interest rate swap market, in which longer tenors had remained available, now also can only provide similarly short tenors: longer tenors may be available, but only at a significant price premium and in relatively small amounts (up to $300 million or so).

The corollary of banks only being willing to commit finance or provide interest rate swaps for shorter periods is that a significant refinancing risk is added to projects. At the end of the initial debt tenor, both base interest rates and interest margins could be substantially higher than they are currently, or debt finance might not be available at all for the required amount. (Equally, there is an upside risk that rates could be lower, which would create a political risk were the private sector to make windfall gains.) Equity investors can only bear the downside risk, if at all, by building a large risk margin into projects, ultimately at the expense of the public sector client.

Another current problem is the difficulty in hedging inflation risk. Historically, projects facing a significant inflation risk (for example, where revenue increases in line with inflation) could create a natural inflation hedge either by issuing a CPI-linked bond or by transacting a CPI swap. The effective closure of the bond markets and the uncompetitiveness of the CPI swap market have meant that the financial markets cannot provide an effective inflation risk hedge.

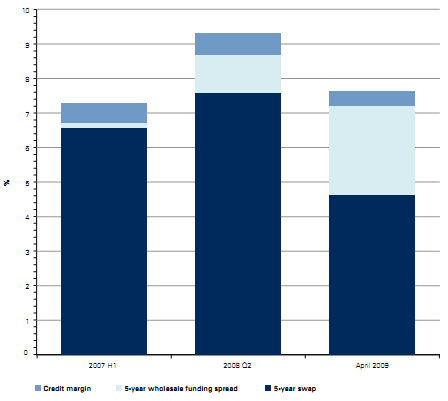

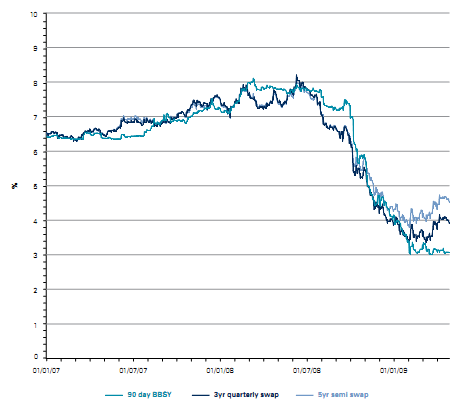

Finally, interest margins and debt fees remain high. Banks' liquidity costs are a major driver, accounting for much of the increase since 2007, as shown in Table 1 and Figure 2 (though wholesale spreads have become increasingly unrepresentative of banks' true term funding costs, which are likely to be substantially lower). Implied credit margins have remained broadly unchanged. Unless banks cease matching the tenor of their funding to that of their loans, interest margins will remain at high levels. On the positive side, base interest rates have fallen substantially from their peak in mid-2008 to well below 2007 levels, as shown in Figure 3, so the increase in total interest costs since the onset of the GFC is much less. Since the second quarter of 2008, when base interest rates were at their peak, the total interest rate for PPP projects since the onset of the GFC has dropped substantially.

| Table 1: Breakdown of PPP project interest costs | |||||

| % p.a. | 2007 H1 | 2008 Q2 | April 2009 | Diff. from ‘07 | Diff. from ‘08 |

| 5-year swap1

| 6.57 | 7.57 | 4.61 | -1.96 | -2.96 |

| Interest margin (5-year)2 | 0.70 | 1.75 | 3.00 | 2.30 | 1.25 |

| o/w 5-year wholesale funding spread3 | 0.13 | 1.09 | 2.59 | 2.46 | 1.50 |

| Credit margin4 | 0.57 | 0.66 | 0.41 | -0.16 | -0.25 |

| Total interest rate4 | 7.27 | 9.32 | 7.61 | 0.34 | -1.71 |

| Sources: 1 Bloomberg 2 KPMG’s estimate for the construction phase of a typical availability-based PPP project 3 CBA Spectrum 4 Implied | |||||

Source: CBA Spectrum, Bloomberg & KPMG estimates

Figure 2: Breakdown of PPP project interest costs

Source: Bloomberg

Figure 3: Base interest rates

__________________________________________________________________________________

2 Debt tenors of over 20 years still are available in the European market from some banks.