Appropriate Measurement and Allocation of Risk

While government borrowing rates are often cited as the most compelling reason to use public financing, a thorough analysis of risk reveals that there is more to value for money than simply interest rates. The valuation of risk transfer is a difficult exercise; yet allocating a financial value to risk transfer is an important way to objectively measure value for money against a public sector comparator.

Proper risk analysis recognizes that conventional capital procurement exposes the government to a number of risks, including design and construction, operation, legislation, regulation, available volume, technology, residual value, finance and employment risks. The risk of construction cost overruns remains one of the most significant risks to be allocated and valued. In the U.K., a 2002 Auditor's survey found only 22% of PPP projects had cost overruns (versus 73% of public projects), with most overruns relatively small and none due to the private sector charging more for the work specified.1The Auditor's study also found 75% of Private Finance Initiative (PFI) projects were delivered on time or earlier (most of the late ones were delayed by two months or less, versus 30% of previously surveyed public projects).2 This is also an important factor when evaluating the value for money of a P3. Another survey determined that PFI projects delivered a 17% risk adjusted savings as against the Public Sector Comparator.3

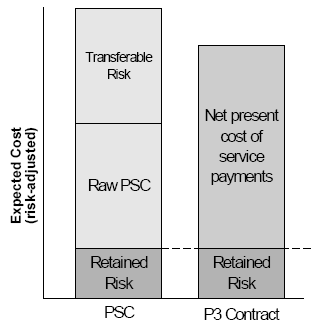

The total risk-adjusted value for money assessment of the PSC and a rival PPP bid should consider not only the raw private construction costs but also the value of risk that may be assumed by the private sector partner rather than by the government agent (see Figure below).

__________________________________________________________________________________

1 National Audit Office, "PFI: Construction Performance" (February 2003), p. 2.

2 Ibid., p. 4.

3 Private Finance Initiative Journal, Vol. 5, Issue 1, March/April 2000, p. 71.