Valuing risks

5.65 It is good practice to add a risk premium to provide the full expected value of the Base Case. As the previous section explained, in the early stages of an appraisal, this risk premium may be encompassed by a general uplift to a project's net present value, to offset and adjust for undue optimism. But as the appraisal proceeds, more project specific risks will have been identified, thus reducing the need for the more general optimism bias.

5.66 An 'expected value' (EV) provides a single value for the expected impact of all risks. It is calculated by multiplying the likelihood of the risk occurring by the size of the outcome (as monetised), and summing the results for all the risks and outcomes. It is therefore best used when both the likelihood and outcome can be reasonably estimated.

BOX 13: EXAMPLE OF EXPECTED VALUE OF BENEFITS

A new policy was originally expected to generate significant benefits, but following concerns that the original predictions were over optimistic, further risk analysis has confirmed that there is now considerable uncertainty about some of these benefits being realised. Four potential outcomes are now considered possible, with NPVs and probabilities assessed as follows:

The costs of implementation have been more rigorously assessed at between £12-17 million, with an expected value of £15 million. The expected net benefit is therefore £8 million NPV. | ||||||||||||

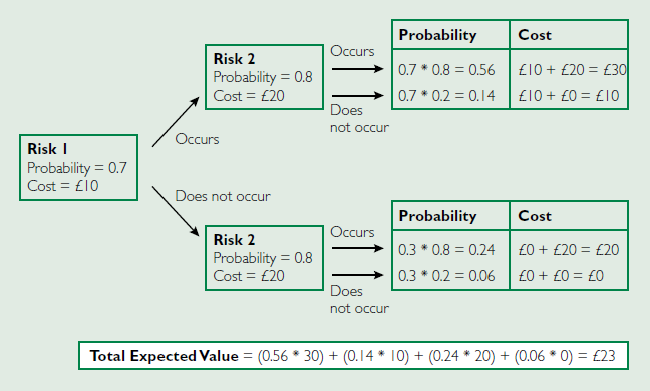

5.67 Decision trees can be useful in this context. They are graphical representations useful in assessing situations in which the probabilities of particular events occurring depend on previous events, and can be used to calculate expected values in these more complex situations. For example, the likelihood of a particular volume of traffic using a road in the future might be dependent on the probability of movements in the oil price. Different scenarios can be analysed in this way.

BOX 14: EXAMPLE - DECISION TREE