PRIORITISING PUBLIC INVESTMENT

2.2 The UK's public services have suffered from a legacy of under-investment. A repairs and maintenance backlog built up on existing assets, and plans for new investment projects were subject to flaws in the budgeting system which encouraged short termism and a bias against capital spending. Public Sector Net Investment fell by an average of more than 15 per cent each year between 1991-92 and 1996-97, and represented 0.6 per cent of GDP in that year - the lowest level for over a decade.

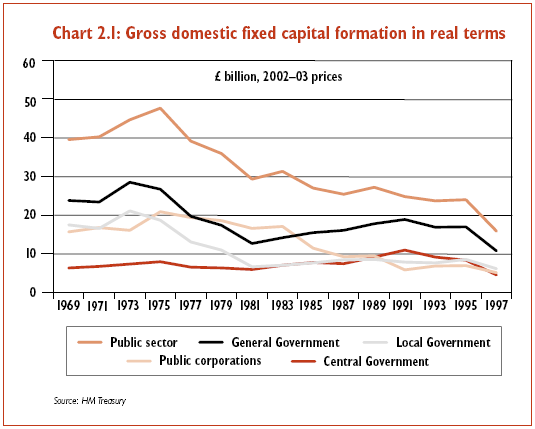

2.3 This fall in public sector investment translated into a marked decline in general government capital spend, in both central and local government, since the start of the 1990s. Chart 2.1 sets out gross fixed capital formation, the acquisition less disposal of fixed assets, by government sector. These figures show the decline in public corporation and local government capital spend caused by the shrinkage of the public sector over the 1970s and 1980s, and also the downturn in capital investment between 1990 and 1997.

2.4 This record of under-investment in assets produced a damaging backlog of repairs and maintenance that has hampered the ability of public servants to deliver high quality services to taxpayers:

• in 1997 the backlog of repairs in schools was estimated at around £7 billion;

• the backlog of maintenance in NHS buildings in 1997 was over £3 billion; and

• the transport sector had suffered from consistent neglect, and a highly damaging lack of investment in infrastructure.

2.5 In order to secure the long-term future of the public services, the Government has significantly increased the total investment flowing into them. By the end of 2005-06, Public Sector Net Investment will be 2.1 per cent of GDP, more than trebling since 1997 as a proportion of GDP and funding sustained investment in the infrastructure of public services.

2.6 To ensure that this increased investment translates into the maximum improvement in public service delivery, it has been matched by reform of the budgeting framework to protect capital investment programmes and to give new incentives for managing the public sector asset base more effectively. PFI represents one option for infrastructure and facilities investment in particular that, in some circumstances, enables the Government to secure value for money for the extra investment it is undertaking.