Accounting treatment of PFI

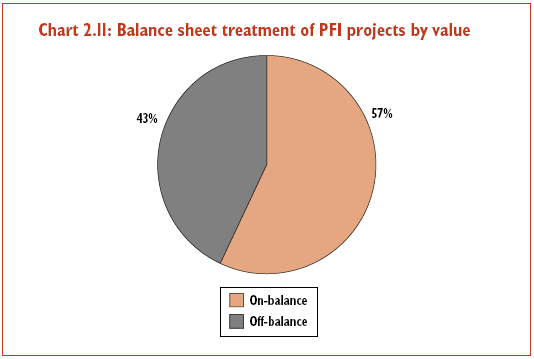

2.26 The accounting treatment of a PFI project on a Departmental balance sheet, and its reflection as an asset in the national accounts, is not material to the Government's decisions about when to use PFI. These are based on value for money alone. In fact, the majority - 57 per cent - of PFI projects by capital value are reported on Departmental balance sheets, as illustrated in Chart 2.11. Accounting and reporting treatment follows rules set by a series of independent national and international organisations, and is decided by independent auditors. (See Annex B for details.)

2.27 It is important to note that, simply because a PFI asset is reported on Departmental or Authority balance sheets, that does not mean that there has been no effective sharing of risks with the private sector, or that the PFI project has secured value for money gains by doing so. As outlined in Chapter 3, the appropriate sharing of risks in a PFI project, leading to their better management, is an important source of its value for money benefits. However, the accounting treatment of PFI assets depends only on a subset of the risks involved in a project, in particular the risks of ownership. For example, accounting treatment does not take into account whether a party bears the risks involved with building a property - a very important subset of risk in major capital projects.