Risk Sharing within a PFI consortium

3.34 With most PFIs the risks transferred by the public sector to the private sector are then reallocated between the different private sector parties participating in the PFI project, using a central consortium company with subcontracts as a means of distributing these risks amongst the private sector participants.

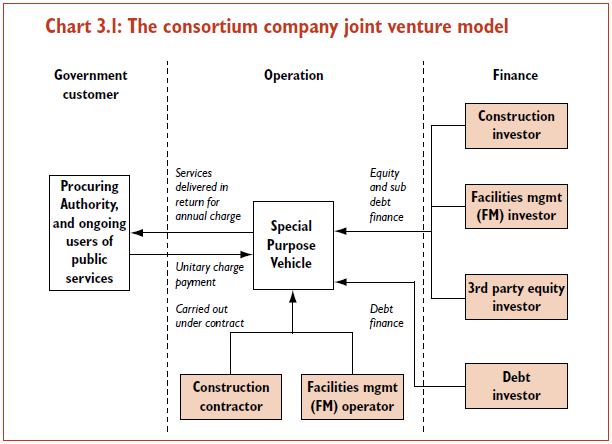

3.35 The consortium company is owned by one or more equity investors. Some of these shareholders may also be contractors to the central consortium company, who undertake to carry out construction, design or facilities management work in the project for a fee from the central consortium company. Others may be financial investors. The consortium will also raise debt finance, in the form of bank debt or bonds, to pay for the construction and operation of the project. It is at risk if the consortium is unable to meet its debt service obligations. Chart 3.1 illustrates the typical commercial structure of a PFI project.

3.36 Within this structure, the private sector reallocates risk to the most appropriate parties. Typically:

• the construction contractor, under a subcontract with the consortium company, takes the design, construction and completion risk;

• the service provider, under a subcontract with the consortium company, takes the risk of timely and cost effective service provision;

• insurers provide protection for risks of damage and business interruption; and

• the consortium company, its lenders and investors are therefore left with a series of residual risks, some of which are credit risks on the subcontractors' performance.

3.37 The benefits of this consortium joint venture structure are that it permits different parties to become involved in the PFI scheme and share the risks effectively. It also permits the involvement of third party funders who must assess the strength of the contractual arrangements and the level of support offered as they rely on these when it comes to repayment of their loans.