Background

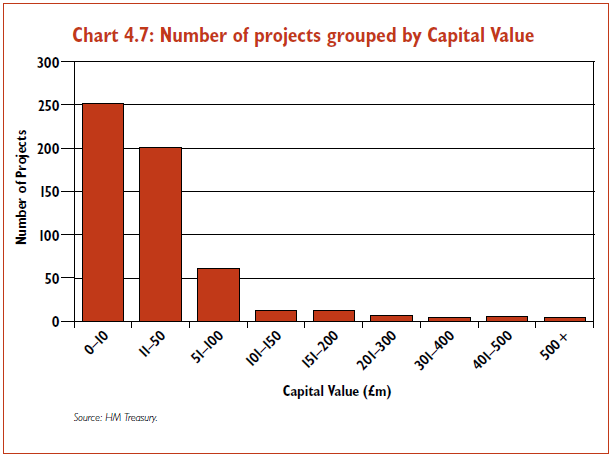

4.27 One important area where research has recently been conducted to determine whether PFI is delivering in practice, and providing value for money overall, is in individually procured PFI projects with a low capital value, which, for the purpose of this research, was defined as less than £20 million. Historically, the number of small PFI projects has been high, as illustrated in Chart 4.7.

4.28 Because of a recognition that the development and transaction costs involved in PFI could be disproportionately high if it was utilised in those projects with small capital values, the Government sought to assess the performance of PFI in these projects and the value for money represented by its benefits. HM Treasury therefore commissioned Partnerships UK to survey projects which:

• were operational;

• involved the provision of a new capital asset under £20 million; and

• were identifiable as PFI, involving unitary charge payments for both the availability of an asset and services associated with it, so as to eliminate from the sample other common forms of procurement in small projects such as outsourcing.

4.29 A sample of 35 projects was selected. Of these, ten were the subject of additional, in-depth interviews.