Overview

9.12 The Government will pursue a small number of pilot projects to test the practicality, attractiveness, and applicability of a different means of funding the senior debt raised to fund some PFI projects which has been called Credit Guarantee Finance. The aim of this scheme is to retain all the benefits to the public sector of banks and insurance companies' risk taking in PFI projects, described in paragraphs 3.54 to 3.59, but funding the PFI project's senior debt requirements with loan finance provided directly by the Government, fully guaranteed by these private risk takers, which it would fund by the issuing of gilts. This approach combines the lower cost of the Government borrowing funds with the benefits of paying a risk premium to private financiers to take, allocate and manage risk. By doing so, this approach offers the prospect of a cost saving in terms of the overall cost of finance for the PFI projects involved.

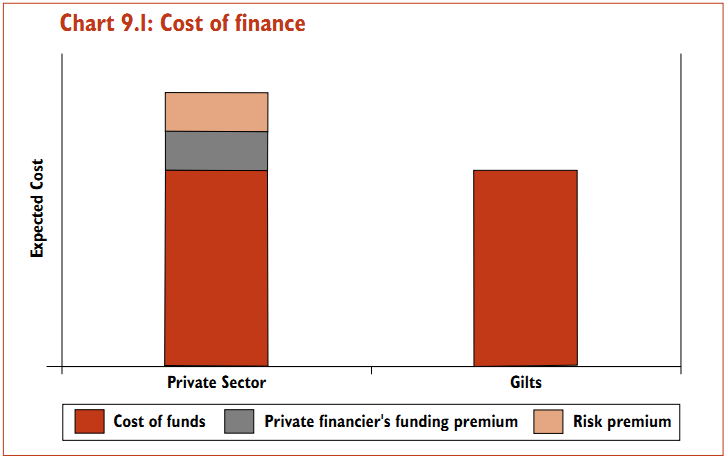

9.13 The cost of private sector debt finance for a PFI, as explained in paragraphs 3.62 to 3.63, contains a risk premium charged by the lenders for assuming, allocating and managing the risks inherent in the project. This risk premium typically 0.3 to 1 per cent, represents good value for money for the public sector in a PFI project, because the lenders' involvement contributes significantly to on time and on budget delivery and whole-of-life costing in PFI investment. This risk premium is not paid in financing conventional procurement through gilts; but the risks in conventional procurement are instead paid for in full by the public sector if and when construction runs over budget or projects are delayed.

9.14 Inherent in raising private finance is the cost of the private sector securing funds in the market due to the higher risk in funding private sector credit providers as opposed to Government (see Chart 9.1). Paying this funding premium has provided good value for money overall, and will still represent value for money in future PFI, because of the benefits flowing from the private sector assuming risks.

9.15 However, the Credit Guarantee Finance option explores a way (for some projects), of continuing to pay a risk premium to the private sector for some projects, but reducing this funding premium and hence improving further overall value for money offered. This option could lead to savings in some PFI projects which pursue it, but it would not be possible to use it for a large number of projects, because of the importance of maintaining a variety of funding sources and bearers of risk and for the reasons set out in paragraph 9.19 below.