Pricewaterhouse- Coopers study

C1 PricewaterhouseCoopers (PwC) have published alongside this document a report which seeks to assess the rates of return bid by private sector participants in the PFI market since 1997, and to assess such private sector return expectations against appropriate industry benchmarks. This report was commissioned by OGC in July 2001. A full copy of this study is available on the web site of PwC. This Annex is a brief extract of some of the data, analysis, and conclusions set out in this report. The study should be read in full for a clear understanding of its analysis and conclusions.

C2 PwC analysed 64 projects that reached financial close between 1995 and 2001, covering a wide sample of activities, such as health, education, office accommodation, prisons, transport, defence and water projects, but excluding IT projects. The total construction value of the sample was £4.4 billion, representing 23 per cent of the total value of transactions closed by the end of 2001, with the average capital value of transactions being £70 million.

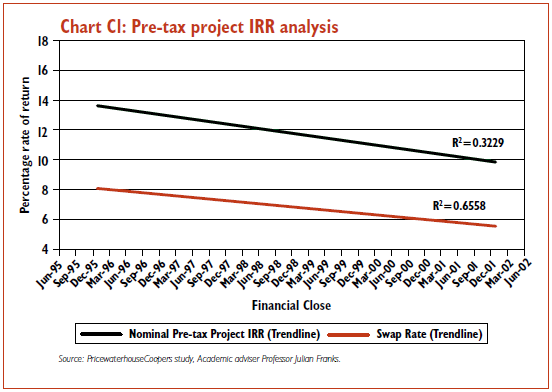

C3 A PFI scheme's cost of finance is the combined cost of its debt and equity, taking account of the proportion of equity in the scheme, usually being ten per cent of the total. The PwC study provides data which is useful in assessing the expected overall cost of capital which is usually referred to as the Project Internal Rate of Return (Project IRR). This is usually equivalent to the cost to the project of the debt, equity return and tax paid thereon. As Chart C1 illustrates, since 1995, this "all-in" cost of private finance has fallen from 13.5 per cent to just under 10 per cent by 2001.