Cost of debt

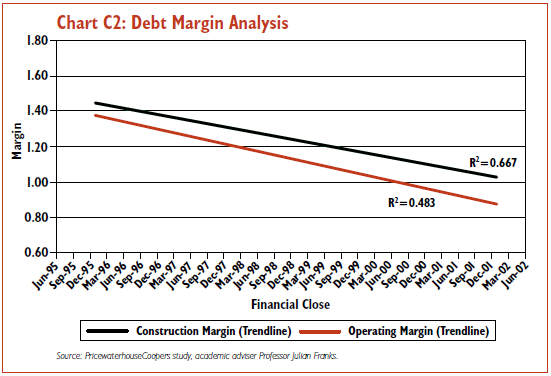

C5 The PwC study also analyses the specific costs of the debt finance used in PFI schemes, which have also been improving from the public sector's perspective over the period of the PwC study. The cost of debt comprises of the margin paid for credit risk taken, the requirement lenders have for equity, which is reflected in cover ratio calculations, and levels of financial gearing and front end fees. Key results of PwC's analysis are laid out below.

C6 The length of the average final maturity of debt achieved for PFI schemes has increased to approximately 30 years, with margins declining 20-30 basis points.

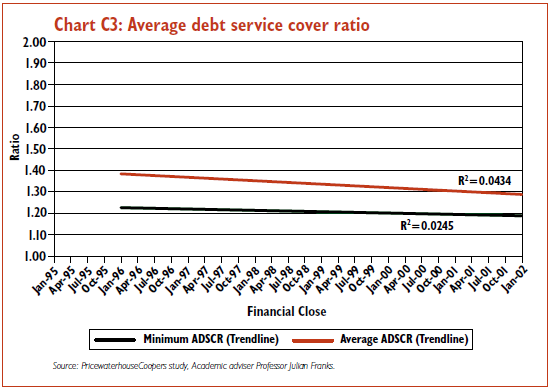

C7 This improvement has been accompanied by a fall in cover ratios from 1.40 to 1.25.

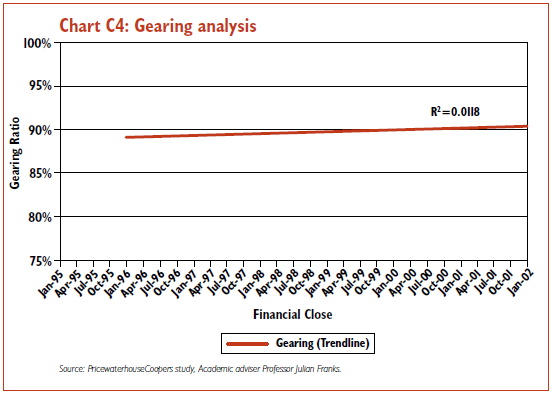

C8 Gearing levels have also increased in part due to the banks' acceptance of lower cover ratios.