CORPORATE COMPARISON

In some roles credit analysts are exposed to both structured transactions (such as project finance deals) and corporate debt issuers. This provides an interesting basis for comparison - and low investment grade corporate issuers simply look and feel different from many similarly rated PPPs. In the transport sector - which is my focus - this difference has widened given the increasing use of benign performance and availability-based payment mechanisms; thus shielding lenders from any market risk. Outside of transport it is very rare indeed for any PPP project to be exposed to the commercial and competitive risks - or operational challenges - that are part of the day-to-day business of running, say, a bus and train operating company (FirstGroup and Stagecoach Group, for example, are also rated low investment-grade).

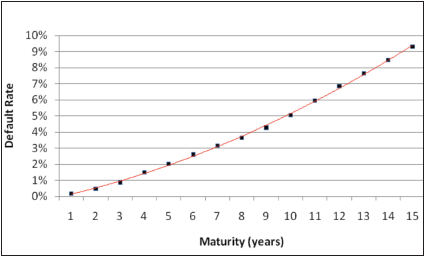

FIGURE 3: CUMULATIVE DEFAULT RATES (BAA2/BBB)

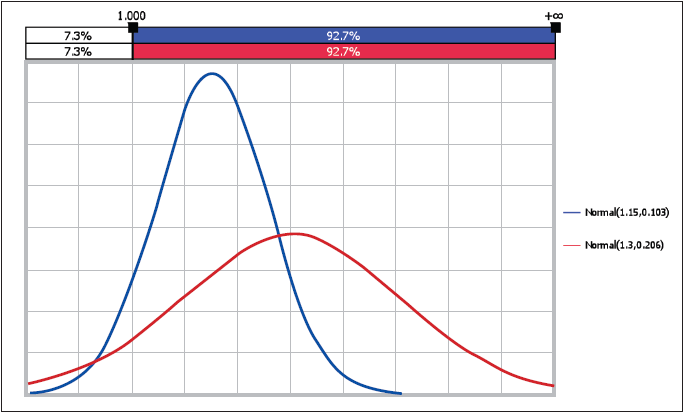

FIGURE 4: CASH FLOW VOLATILITY AND PROBABILITY OF DEFAULT

One counter-argument points to the 'aggressive' nature of PPP financing. High leverage and low coverage ratios are certainly the norm. However, credit quality can be assessed as a blend of business and financial strengths/weaknesses - and it's difficult to identify many business weaknesses in the case of post-construction PPP schools, office and accommodation projects, hospitals and availability-based road and rail projects. Just how aggressive do the financials have to be for the blended view of creditworthiness to sit at 'BBB'?

Perhaps there has been over-emphasis placed on the absolute values of coverage ratios, whereas more attention should be paid to coverage ratio volatility or absence thereof? As the illustrative example in figure 4 demonstrates, if you halve cash flow volatility (standard deviation), you can significantly reduce the coverage ratio - in this case, from 1.3x to 1.15x - yet still retain the same probability of default (7.3% sitting south of 1.0x; the 20-year cumulative default rate for an 'A'-rated credit).

Regular contractual cash payments from 'AAA' or 'AA'-rated public- sector counterparties - none of whom have ever defaulted on their PFI payment obligations - to established, inflation-insulated projects operated by experienced contractors (and easily-replaceable sub-contractors) suggests a degree of financial stability and predictability seldom observed in the world of corporate issuance. Historical analysis of cash flow stability from existing PFI projects would give greater insight into the coverage ratio differentials that could be maintained by different credits (with contractual versus market-based income streams) at the same rating level. It would also suggest when the ratings - on PFI shadow toll roads and schools, for example - should draw distinctions.