JUSTIFY THE RATINGS

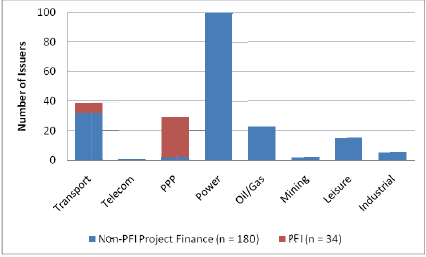

One of the most valuable services that rating agencies provide to the investor community is the publishing of generally high-quality credit research pieces. Recently, each of the 'big three' agencies has published articles on project finance default, recovery or both. However, this is of limited use to the PPP industry. Project finance is employed in a myriad of sectors - often as a risk mitigant in speculative, technology-driven (sometimes emerging-territory) investment ventures such as telecoms, power, oil and gas exploration, and mineral extraction. Where is the common credit ground with social infrastructure PPPs in the UK, Canada or Australia? Furthermore, as PPPs are but a small subset of the rated project finance universe (UK PFI projects represent 16 percent of S&P's project finance portfolio - see Figure 5) PPP-specific credit traits and trends can easily be masked in any aggregate analysis of project finance loan performance.

FIGURE 5: S&P'S PROJECT FINANCE UNIVERSE BY SECTOR

PPPs are different. They deserve to be treated as an asset class of their own. Launched back in the mists of time before Yahoo was born, Nick Leeson was arrested and the DVD arrived, it would not seem unreasonable to expect some specific statistical research and in-depth analysis - not just descriptive narrative - from the rating agencies. Gone are the days when reliance had to be placed on conjecture and theory; when an absence of visibility supported a fundamentally conservative stance. They could start with international empirical evidence. How have these assets (rated and non-rated) performed? How many have defaulted and under what circumstances?

How do they stack up against project finance transactions in other sectors? How does recovery compare? What is the evidence base used to justify the current ratings? I'm sure such an article would attract a wide audience. The primary focus for the research reported here has been availability or performance-based PPP projects in the UK. The research examined the sector from a number of different perspectives: historical performance, analytical heritage, contractual robustness and comparisons with other rated entities. Various parties were consulted, and many credit commentaries, rationales and rating reports were reviewed - yet the conclusion is the same. In the absence of a well-grounded, evidence-based defence, PPP ratings simply look conservative. Very conservative.

The issues raised here won't go away. With the passing of time, more UK PPPs will celebrate their 10th anniversaries - on their way to 15. By then, as Figure 3 (p41) demonstrates, the default rate for 'BBB's will be close to 10 percent. That's around 60, maybe 70, PPP defaults - a mammoth hike from today's estimates. Given that the sector has survived successive political changes and the deepest financial and economic crisis that most of us have witnessed, precisely where are these defaults going to come from?

Robert Bain is an independent consultant and a visiting research fellow at the University of Leeds School of Civil Engineering