How is Value for Money Estimated?

The value for money analysis is prepared in accordance with the methodology detailed in this document by an external advisory firm with relevant experience, such as a professional services firm, in collaboration with IO management for presentation to the IO Board of Directors.

The VFM assessment is based on detailed project specific information from multiple stakeholders. This information is used to develop two financial models:

Model #1 Public Sector Comparator (PSC) | Model #2 Adjusted Shadow Bid (ASB) |

Total estimated costs to the public sector of delivering an infrastructure project using traditional procurement processes | Total estimated costs to the public sector of delivering the same project to the identical specifications using AFP |

The difference between the estimated total project costs under each model is the VFM.

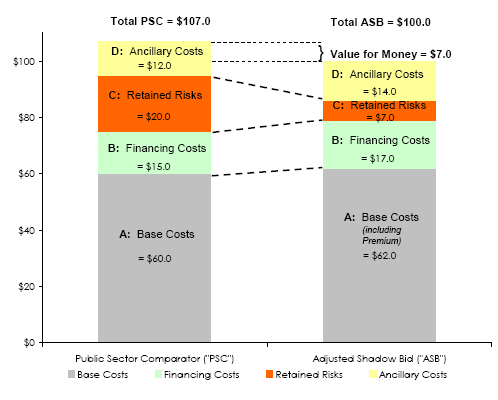

In the illustrative BF VFM analysis (figure #1), the PSC is shown as the stacked bar on the left of the graph and the ASB is shown as the right hand bar. Both are expressed in terms of dollars measured at the same point in time.

Figure #1

Illustrative BF VFM ($'s millions):

The comparative cost components will vary slightly in magnitude between the two procurement methods (as shown by the coloured segments in the figure above). The difference between the estimated total project costs is the VFM and is calculated as:

Sample Value for Money Calculation (Traditional Project Costs) - (AFP Project Costs) = (Total PSC) - (Total ASB) = $107.0 - $100.0 $7.0 = 0.0654 Stated in percentage terms, the VFM for the sample |

Under AFP, the estimated base costs (including premium) and the estimated financing costs are together known as the shadow bid. It is when the other cost components such as retained risks and ancillary costs are added to the shadow bid that one arrives at the adjusted shadow bid (i.e. adjusted for risks and ancillary costs).

When bids are received, they consist of base costs (including premium) and financing costs (i.e. exactly the same components as the shadow bid). When reassessing VFM at this stage, the shadow bid is replaced by the preferred bid, and adjustments are once again made for risk and ancillary costs to arrive at the adjusted preferred bid. This adjusted preferred bid is compared to the updated PSC.

The following sections will detail the methodology that is followed on IO projects to develop each of the cost components that make up the PSC and ASB, leading to the VFM calculation. The cost components in the VFM analysis include only the AFP portions of the project costs. Non AFP related project costs, such as land acquisition costs, that would be the same irrespective of the delivery method are excluded from the VFM calculation.