2. Previous Benchmark studies

Previous comparative studies of contemporary PPP projects and Traditional projects are summarized in Table 1. Each of these previous studies has suffered from a difficulty in obtaining sufficient data to make a complete comparison of PPPs to Traditional projects, this difficulty has in part been due to the lack of whole of life costs associated with Traditional projects and the commercial in confidence nature of actual project data. The result is that whilst this study has had access to commercial in confidence data it lacks information on whole of life costs for Traditional projects and thus comparisons are only possible for capital costs.

The UK Treasury Taskforce report [1] was mainly based on 21 projects as detailed in their business cases, the UK Mott MacDonald report [2] retained data from 50 projects albeit that some of these projects lacked key data, the US report by Haskins et al [3], the UK NAO [4] report and the Victorian Fitzgerald review [5] were all based on small samples that only considered time and cost data for the period between budget and final delivery of the facility. This limitation in these earlier studies led to considerable debate as to what was actually being compared as PPPs have tended to have considerable more effort put into establishment of the budget (as part of a Public Sector Comparator or reference project) whereas many Traditional projects seek a budget which is refined then tested via a competitive bidding process. This difference in approach gave rise to comments that comparative studies based on this budget to actual completion simply removed some optimism from the budget rather than reflecting any true difference between the performance of PPPs and Traditional procurement.

The 2007 Australian Allen et al report [6] attempted to overcome this deficiency in previous studies by comparing costing data over a range of time periods that included: from initial announcement of the project to final, budget to final and from contract execution to final. This study was based solely on publicly available data and thus requires confirmation based on actual verified project data.

This study seeks to address identified gaps in past studies.

The results of these former studies, refer Table 1, are presented as either normailsed time and costs (normalised against budget data1 for Mott MacDonald and Fitzgerald and normalised against the original announcement data for the Allen study). The UK Treasury report [1], the NAO report [4] and that of Haskins et al [3] provide percentile performance data. All previous studies reviewed indicate PPPs perform considerably better in respect to cost than that of Traditional procurement. The difference between PPPs and Traditional procurement is less definite for time performance; the NAO report [4] indicates that PPPs are considerably better than Traditional projects for time performance whereas the Allen report [6] indicates time performance is generally similar for the projects except that PPP projects are not adversely affected by an increasing scale of the project as was identified for Traditional projects.

Table 1:Comparsion of previous benchmark studies (source Duffield 2008)

| BENCHMARK COMPARISON | Treasury Taskforce 2000 [1] | Mott MacDonald2002 [2] | Haskins et al2002 [3] | NAO 2003 [4] | Fitzgerald 2004[5] | Allen Consultingetal 2007 [6] |

| Number of projects in sample | 21 | 50 | <10 | <10 | 8 | 54 |

| Cost (CAPEX) - Normalised PPP performance (Budget to Actual) • General - Cost savings from PPPs | 17% | 30-40% | 78% on budget | 0.91 | 1.03 | |

| - Normalised Traditional project performance (Budget to Actual) • General • Standard buildings • Standard Civil Engineering • Non-standard buildings • Non-standard engineering | 1.24 1.44 1.51 1.66 | 27% on budget |

1.25 | |||

| Time performance - Normalized PPP performance (Budget to Actual) • General |

76% on time |

1.12 | ||||

| - Normalised Traditional project performance (Budget to Actual) • General • Standard buildings • Standard Civil Engineering • Non-standard buildings • Non-standard engineering |

1.04 1.34 1.39 1.15 | 30% on time | 1.13 |

In a critique of the Mott MacDonald [2] and UK NAO results [4], Unison [7] outlined a number of methodological problems that it considered were biasing the empirical findings in favour of PPPs. This report addresses previous criticisms of earlier studies by:

• being transparent in the sampling methodology;

• describing the population analysis;

• outlining the sample and explaining how it is representative of current experience;

• the time period for both PPP and Traditional projects is the same; and consistency in comparison removing measurement bias.

____________________________________________________________________________

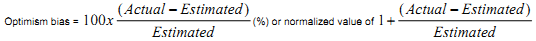

1 In the Mott MacDonald report this normalized data for cost was termed 'Optimism Bias' and defined as:

s