Cost comparison

In terms of a comparison of cost performance between Traditionally procured infrastructure and that procured via a PPP mechanism it is concluded that:

Conclusion 3: | Over all time periods considered in this study, PPPs delivered projects for a price that is far closer to the expected cost than if the project was procured in the Traditional manner. Based on the inter-quartile percentage for the period from initial project announcement to the actual final cost, PPPs were 31.5% better than traditional projects. |

| Note: ▪ This finding was confirmed regardless of whether the analysis involved average results, percentiles or simply the number of projects that achieved the target cost. The conclusion also holds true for all time periods involving the original announcement of a project, the budgetary approval, the bidding phase or the actual delivery of the infrastructure during the construction period as explained below. ▪ From the original announcement to final actual cost (the full period) PPPs perform 28.2% (based on averages, refer Table 5) better on cost than Traditional projects. The median (P50) result for PPPs from the study was 9.4% better (refer Table 6) than for Traditional projects and PPPs had a far greater cost certainty (31.5% better) than Traditional projects as measured by the difference in the inter-quartile percentile range. Similarly 16.7% (refer Table 7) more PPP projects were completed within the original expected cost estimate over the full period (if an acceptability criterion of ± 5% was set) than was the case for Traditional projects. |

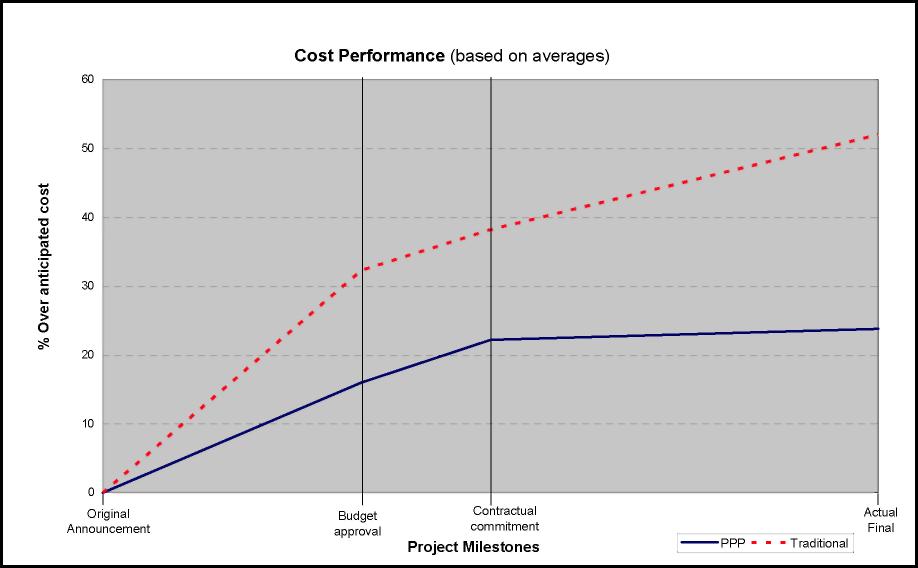

The cost analysis for the periods: Original Announcement to Contract, Budget Approval to Actual Final and Contractual commitment to actual final, led to the same conclusions (with differing metrics) as for the full period. These results are presented graphically as Figure 7 to demonstrate this finding.

Figure 7: Cost performance over project initiation and delivery (source: Duffield 2008)

The contractual sum for PPPs, as determined when the contracts were signed, has a P50 of zero when analysed against the actual final price, this result has a variance as measured by 50% of the records (P75 - P25) of 1.4%. This is a far more certain outcome than for Traditional projects that had corresponding results of P50 of 3.6% cost overrun with a variance as measured by 50% of the records (P75 - P25) of 17.4%. It is concluded that:

Conclusion 4: | PPP contracts had an average cost escalation of 4.3% post contract execution compared to Traditional projects that had an average cost escalation of 18.0% for the same period. PPP projects provide far greater cost certainty than Traditional contracts and there is little variation in cost of a PPP project after the contract is signed. |

The findings of this study are consistent with the findings of the 2007 Allen et al [6] study. It is further observed by comparison with previous studies; refer Table 1, that Traditional projects in Australia have greater cost certainty than such projects in the UK.

Conclusion 5: | Australian Traditional projects have better cost performance than UK projects with 43.3% of Traditional Australian projects being completed within 5% of the expected cost compared with 27% of UK Traditional projects being completed within budget, refer NAO [4]. |