3.2.11.2 Risk adjustments

Risk and uncertainty are inherent in all projects, no matter the size.

For project management, the most serious consequences of risk can be broadly characterised as:

• failure to keep within the cost estimate

• failure to meet the completion date

• failure to achieve the required quality and operational requirements.

Risk is all too often ignored or dealt with in an arbitrary way, by, for example, simply adding 10% "contingency" onto the estimated cost of a project. This contingency is almost certain to be inadequate and will result in cost overruns and delay. It is therefore essential that risk is identified and valued, where possible, in order to gain a full appreciation of the likely cost to government of pursuing the project.

The identification and costing of risks is particularly important, as risk allocation and its financial consequences will play a key role in assessing value for money and contract negotiation.

In practice, it is likely that some combination of the individual risks identified (whether quantified or not) will be encountered. It is therefore important to make some assessment of the implications of the combined impact of the identified risks. It must also be recognised that not all identified risks will be quantifiable. It is therefore important that these risks are also captured in the analysis (not only for business case development, but also during bid evaluation).

The analysis of the combined range of identified and quantified risks provides a greater understanding of the risk spectrum or "volatility" that is inherent in the project. Volatility can be considered in terms of a probability (or confidence) limit that is usually expressed as the "P90" - the range of outcomes bounded by the fifth and ninety-fifth percentile probability outcomes (refer to Appendix 3 for further details).

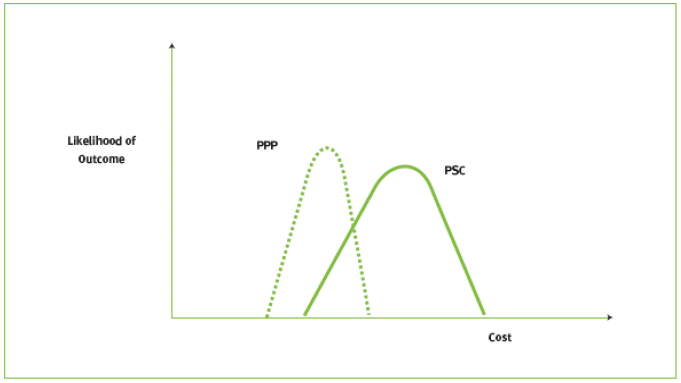

Figure 5 illustrates the inherent volatility of the costs of a traditional approach, compared with that of a public private partnership option. In this case, where government retains more risk under traditional procurement than under public private partnership, the potential range of cost outcomes for the public sector comparator is wider than that for the public private partnership.

The analysis of risk both in terms of expected cost (single figure estimation) and volatility is very powerful, as it provides a full understanding of the inherent uncertainty in the project.

Figure 5-Risk volatility comparison

The public private partnership delivery mechanism may be preferred over the alternative public sector comparator delivery, as it offers government a reduction in its overall exposure to risk volatility.

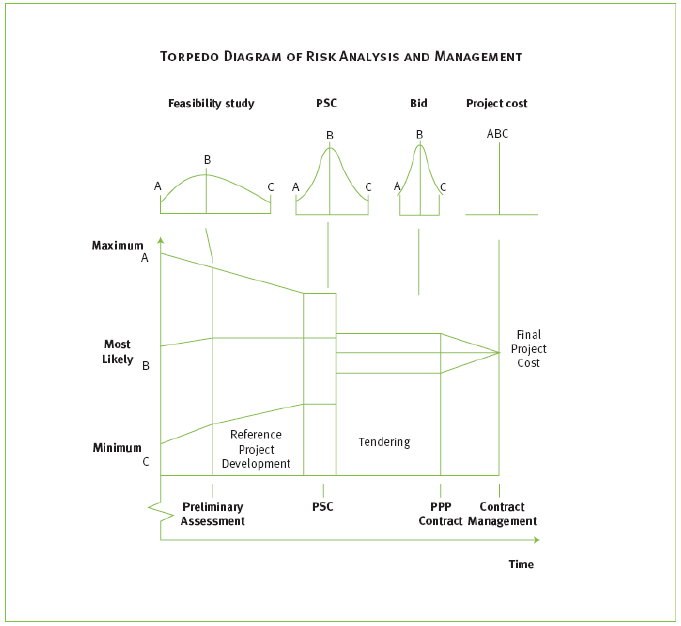

It is important to recognise that probabilities and uncertainties in cost prediction vary from stage to stage and therefore so do the measures of likely cost outcome and volatility. The quantifications of risk at the identification and appraisal stages of a project should be detailed enough to give a reasonable upper limit for the project. Then, as risks and uncertainties are removed or reduced, the risks should reduce.

Figure 6 illustrates the effect of risks on cost predications at different stages during the project. This so-called 'torpedo' diagram illustrates how the development of the reference project generally results in a better understanding of the risks associated with the project and a corresponding reduction in the spread of potential outcomes. The step down between the public sector comparator and the public private partnership contract represents the expected value for money outcome, albeit with some uncertainty associated with the retained risks. Final out turn cost will not be known until the end of the contract, but should lie within the range estimated at contract award.

Figure 6 – Total Diagram of Risk Analysis and Management