RESOURCE SEEKING: RESOURCES ARE A DIMINISHING SHARE OF GLOBAL FDI

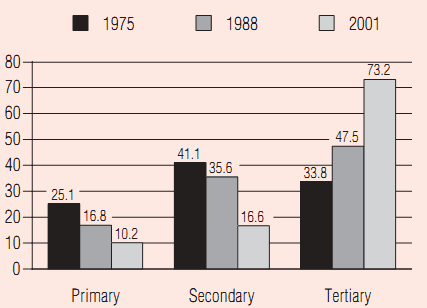

Canada's other traditional advantage in attracting foreign direct investment has been its rich natural resources. But globally the proportion of primary sector FDI has fallen during the last couple of decades while the share of service/tertiary sector FDI has risen (See Chart 6.) This could be another reason why Canada's share of global FDI has fallen.

|

* Includes FDI flow among NAFTA countries |

Chart 6 World FDI Inflow, Sector Breakdown (per cent) |

|

Sources: The Conference Board of Canada; UNCTAD, World Investment Report 1999, Table 7, p. 17; UNCTAD, World Investment Report 2003, Table A.1.4, p. 192. |

Natural resources in Canada have been exploited extensively over the last century. But although there are still forest, mineral, and oil and gas resources left to be developed, the costs of exploring and exploiting these resources have increased. Accessing new resources has also been challenging because they are more remote and because of Aboriginal and environmental concerns. Companies that access resources on or close to Aboriginal reserves must maintain positive relations with Aboriginal communities and deal with uncertainty over the outcome of Aboriginal land claims. Canada's expensive environmental assessment reviews, as well as pressures by environmental groups and the public against logging, mining and energy resource development, can make Canada less attractive for FDI.

Other countries offer better access to rich resources at less cost. They may also have lower environmental standards, but this is not a primary draw for foreign multinationals. These corporations, which frequently have to meet higher standards in their home markets, prefer to maintain the same high level of environmental stewardship throughout their worldwide operations. By adhering to a uniform set of standards, these companies simplify management and compliance issues. They tend to invest in countries because they can reduce exploration, development and operational expenditures while maintaining good environmental management practices.

Other countries offer cheaper access to high-quality natural resources. |

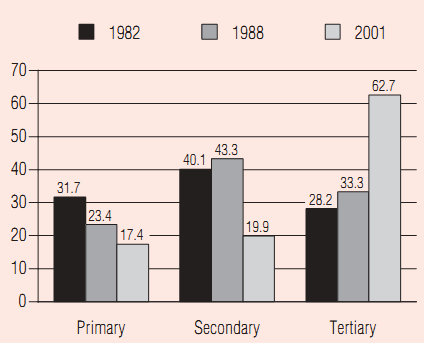

A sectoral comparison of world FDI inflow (see Chart 6) and Canadian FDI inflow (see Chart 7) shows that the importance of the primary sector has declined significantly during the last two decades in both cases. However, the proportion of primary sector FDI inflow in Canada is still 70 per cent higher than the world average. This fact underscores the importance of resources and the impact of fluctuations in world commodity prices on Canada's economy and pattern of FDI inflow. The projected rise in global commodity prices may attract new foreign direct investment into Canada, but other resource-rich countries will offer stiff competition.

Chart 7 Canadian FDI Inflow, Sector Breakdown (per cent) |

|

Sources: The Conference Board of Canada; OECD, International Direct Investment Statistics Yearbook 1993 and 2002. |

Canada must be alert when competing for FDI in the resource sector. One corporate executive (from a forest products multinational) stated that the opportunities provided by fast-growth forests in regions such as Latin America and Asia-Pacific disadvantage Canada in new investment decisions by global forest products companies. Another multinational corporate executive (from a global chemical products company) mentioned that Canada's advantage in accessing natural gas as a feedstock has disappeared with the significant increase in natural gas prices in North America.