TAXES AND REGULATIONS

Part of the business environment is the taxation and regulations imposed by governments at all levels. Tax rates affect foreign direct investment decisions in various multifaceted ways. They are factored into rate-of-return estimates on various investment options, and they serve as an indicator of a government's sentiment toward business. As for regulations, costs to business are usually difficult to estimate. Nevertheless, investors do make qualitative assessments of the burden and of whether governments properly recognize the needs of business while also meeting public interest goals.

| Tax rates affect investment decisions in many different ways. |

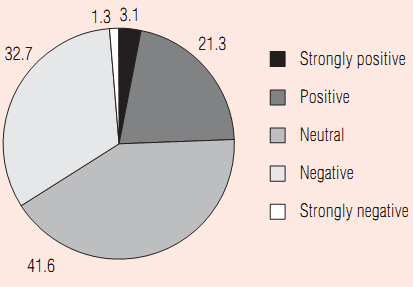

A comprehensive OECD study2 measuring effective tax rates on inbound and outbound FDI ranked Canada, along with Iceland and Japan, as high-tax host countries throughout the 1990s. However, more than 45 per cent of our survey respondents found that Canada's taxation was favourable to foreign investment, while only 16 per cent considered it unfavourable. (See Chart 13.) This result stands in contrast to recent findings from the World Economic Forum, which show that tax rates, followed by tax regulations, are the chief deterrents to doing business in Canada.3 Business executives clearly have differing opinions regarding Canada's tax regime and its impact on investment. This is not surprising given the multifaceted impact of taxation on investment decisions.

In the interviews, executives of foreign multinationals outlined three aspects of the relationship between taxes and investment decisions. First, taxes are a cost that must be factored into the calculation of rate of return on investment. Higher taxes can offset other factors that raise the pre-tax rate of return on investment.

Second, there is the issue of certainty. Direct investments are made with a view to the long term, and countries whose future tax rates are uncertain or are moving upward are at a serious disadvantage, regardless of current levels. Canada scored well here, since tax rates are generally coming down. The federal government, in particular, received praise for its efforts to build confidence in tax rate stability over a reasonable time horizon. Several executives noted, however, that provincial governments are lagging in this area, and there are concerns that they may reverse the trend as is the case in Ontario and Quebec.

Finally, there is the disposition of governments toward the private sector generally and investment in particular. This is reflected, in part, in the types of taxes that governments impose. The capital tax in Canada was regularly condemned as a tax on investment, and some foreign executives interviewed cited it as evidence of governments' negative attitude toward business. The gradual elimination of the federal capital tax will likely improve investor perceptions, but once again provinces need to take note of this issue.

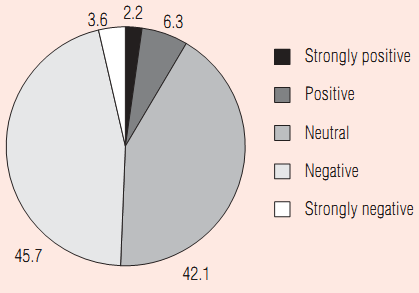

In terms of market regulation and supervision activities, they were seen by survey respondents as neutral to slightly negative. (See Chart 14.) However, when asked about Canada's environmental, health and safety regulations, more than half the foreign investors surveyed believed these regulations had a negative impact on investment decisions. A further 44 per cent felt such regulations had a neutral effect on their corporate investment decisions. In the interviews, several executives said the real problem with regulation is not so much the content but the time it takes to work through the regulatory process, especially when different levels of government are involved. The whole process is seen as excessively bureaucratic and time-consuming.

| Chart 14 Impact of Market Regulations/Supervision on FDI Decision (per cent) |

|

|

| Source: The Conference Board of Canada. |

Canada fares less well in international comparisons of direct restrictions on foreign direct investment. A recent OECD study4 found that Canada has the second highest level of statutory restrictions on inward foreign direct investment among the OECD countries (after Iceland). Although Canada had relatively few restrictions in manufacturing and business services, it scored poorly (i.e., had many restrictions) in transportation, telecommunications and electricity. The level of restriction on banking was also high, while on insurance it was close to average. The study suggests that Canada has some way to go in bringing its statutory restrictions on FDI into line with those of its major competitors and improving its image as a country that welcomes direct investment.

The overall role of government in making Canada conducive to investment was seen as neutral by about 42 per cent of respondents, while about 46 per cent indicated a negative impact. (See Chart 15.) This perception is largely due to strict market regulation and supervision.

| Chart 15 Overall Impact of Canadian Governments on FDI Decision (per cent) |

|

|

| Source: The Conference Board of Canada. |

While the survey did not directly ask how Canadian attitudes affect foreign direct investment, various executives volunteered that Canadian public opinion, reflected in both government and the press, is anti-business. One executive noted that business people are portrayed as "ogres" in Canada. Another noted that government has a consistent anti-business posture. This view was echoed in some of the interviews. One executive felt that this is one of the more worrisome aspects of investing in Canada.