1.2 The accounting treatment of PPPs

Central (or local/regional) government accounts may be compiled on a cash or an accrual basis2. EU Member States are tending to move away from a cash-based accounting system to an accrual-based accounting system. Many have adopted a hybrid system. This trend is aimed at assimilating public accounts to financial statements used by private entities.

PPP activities are reported in central (or local/regional) government accounts for scrutiny and decision-making purposes. Indeed, such reporting:

• fosters accountability and provides control means for supervisory bodies, legislators and public constituencies

• provides a source of economic and financial information and control for decision-making purposes when accounts are compiled on an accrual basis.

The PPP accounting treatment in central (or local/regional) government accounts is carried out through the classification of the assets established by the PPP transaction. The classification serves to determine whether or not the PPP assets should be recorded as central (or local/regional) government assets and registered on the central (or local/regional) government balance sheet with a corresponding public sector liability. While the majority of EU countries have based this classification on general public sector accounting standards, only a few have issued specific guidelines or advice to specifically tackle the classification of assets involved in PPPs3.

The original purpose of public accounting was to provide accountability, but its methodology limited the provision of information for decision-making purposes. Accountability has been normally provided via a single entry cash basis budget accounting, which did not offer information about assets and liabilities or charge for the cost of capital, depreciation and the maintenance of assets. It also did not provide information on the performance of services provided. Recent trends in public accounting intend to provide economic and financial information for decision-making purposes and to reduce differences between public and private accounting. The gradual introduction of double entry and accrual basis accounting, as well as the use of private-sector-style accounting (e.g. balance sheet, income statement) has enhanced the value of public accounting, particularly in relation to the control of the fiscal risk and the assessment of future commitments. |

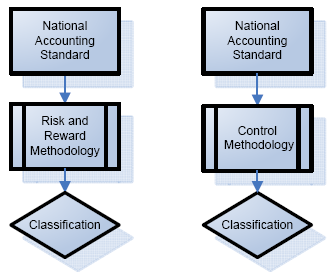

The classification of the assets of a PPP is based on accounting standards defined at the national level. Each country has adopted its own accounting system based on specific accounting standards. These systems have specific rules for identifying entities belonging to the government sector and for reporting operations.

In the absence of internationally adopted standards for PPPs, most EU countries have relied on the accounting standard used for leases. These standards, interpreted in the light of ad-hoc guidelines, have allowed public sector accountants and auditors to assess whether the assets created through a PPP belong "in substance" to the public sector. This assessment is based on an "economic risk and reward" test, or criterion.

The fundamental principle of this criterion is that if "most project risk" has been transferred to the entity which is partner to the government in the PPP (the "nongovernment partner"), then the assets involved in the PPP should not be reported on the government balance sheet. To date, most EU countries have adopted this criterion. Yet, they use somewhat different methodologies to determine when sufficient (or most risk) is transferred to the non-government partner.

Lately however, some countries have changed, or are considering changing, accounting standards in a way that would require the application of a "control criterion" as the basis for the classification of PPP assets. Their objective is to increase transparency of government activity by also reporting in the central (or local/regional) government accounts those projects that are initiated and "controlled" by the government. This would apply even when the projects concerned are financed indirectly through the private sector and when the majority of risks are borne by nongovernment entities4. This criterion differs from the "risk and reward" criterion as it considers two features in particular:

• The control or regulation of the services the non-government partner must provide; and

• The control over the residual value of the PPP assets at early termination.

The logic behind this approach is that if a government initiates the construction of an asset, specifies its characteristics and retains the ultimate responsibility for it (i.e. the asset is unlikely to be of use to anyone else) then it "controls" the asset and should report it on its balance sheet5.

Government financial reporting based on a

"risk and reward" and "control" criterion

Both the "risk and reward" and "control" criteria are based on a "substance over form" approach looking at the economic substance rather than the legal appearance. Economic ownership of an asset, which is the determining factor for the balance sheet treatment, is defined on the basis of the economic substance of the relations between the asset and the entity that exerts control over the asset and is exposed to the benefits and costs of its ownership. Legal ownership and economic ownership often coincide. When they do not coincide, a "substance over form" approach should prevail for accounting and statistical purposes. National and international accounting frameworks have adopted several criteria to determine the economic ownership of an asset. The following are generally adopted: "Risk and reward" criterion: the economic ownership of an asset lies with the party that possesses the asset and carries the risks, benefits and burden in connection with the asset6. "Control" criterion: the economic ownership of an asset lies with the party that (i) controls what services the non-government partner must provide and (ii) has control over the residual value of the asset in case of early termination of the PPP contract. |

_______________________________________________________________________

2 When accounts are compiled on a cash basis, income is not counted until cash is actually received and expenses are not counted until actually paid. When accounts are compiled on an accrual basis, transactions are counted when the order is made, the item is delivered or the services occur, regardless of when money (receivables) is actually received or paid. PPP asset classification on public balance sheet is based on the use of an accrual or hybrid accounting only.

3 For England see the H.M. Treasury, Government Financial Reporting Manual "Section 6.50 Accounting for PPP arrangements, including PFI contracts, under IFRS" and "Section 5.4.59 Commitments under PFI contracts available at http://www.hm-treasury.gov.uk/d/2010_11_frem_full_version.pdf.

4 Other non-EU public bodies have expressed disaccording opinions on this issue. The State of Victoria Public Account and Estimate Committee report on Public Private Partnerships (see http://www.parliament.vic.gov.au/paec/inquiries/infrastructureinvestment/Report/Private%20investment %20in%20public%20infrastructure.pdf) has considered the control criterion too simplistic and not properly suitable to address the substance of complex commercially negotiated arrangements. On the contrary, South Africa's Accounting Standard Board "Guideline on Accounting for PPPs", (see http://www.ppp.gov.za/documents/Guideline%20on%20Accounting%20for%20PPPs.pdf) adopted the control approach in determining whether the government should account for the asset and related obligation in a PPP agreement.

5 Only the first criterion applies when the economic life of the assets coincides with the duration of the PPP contract.

6 European System of Integrated Economic Accounts ESA 95, paragraphs 7.09-7.10