1.3 The statistical treatment of PPPs in National Accounts

EU Member States are obliged to prepare National Accounts to a common format as defined in the European System of Integrated Economic Accounts (ESA 95). These accounts are prepared by national statistical offices (often with the involvement of representatives of national central banks and ministries of finance) and reported to Eurostat. The production of public finance data in National Accounts is a legal requirement for Member States under European regulation, in particular under the Excessive Deficit Procedure (EDP).

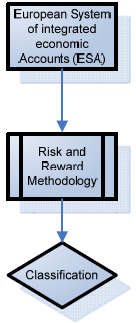

ESA 95 sets out how PPPs are to be treated for the purposes of these statistical analyses, and notably whether or not PPP assets should be recorded or not as central (or local/regional) government assets with a corresponding public sector liability.

ESA 95 has specific rules for identifying entities belonging to the government sector and for reporting operations. Chapters VI.4 ("Public infrastructure financed and exploited by corporations") and VI.5 ("Public-Private Partnerships") of the "ESA 95 manual on government deficit and debt" (ESA 95 Manual) complement and clarify ESA 957.

ESA 95 requires that National Accounts are to be compiled on an accrual basis and use a "binary" reporting system: assets are to be classified either as wholly government assets or as wholly non-government partner assets (i.e. their ownership cannot be split between the government and non-government partner).

Under ESA 95 the assessment of whether a PPP asset is to be counted as governmental is based on a risk transfer test (i.e. a "risk and reward" criterion). Where "most of the project risk" has been transferred to the non-government partner, the assets involved in the PPP are deemed "off" the public sector balance sheet. According to ESA 95, most risk is transferred to the non-government partner when the project construction risk and either availability or demand risk are transferred.

Definition of primary PPP risks according to Eurostat Construction risk covers events related to the initial state of the asset(s) involved in the PPP. In practice, construction risk is related to events such as late delivery, non-respect of specified standards, significant additional costs, technical deficiency and external events (including environmental risks) triggering compensation payments to third parties. It is considered that the government bears the majority of the construction risk when it covers systematically the majority of any additional cost incurred, for whatever reason, during construction or when it is obliged to make payments as a consequence of a default of the non-government partner in the management of the construction of the asset(s), either as a direct supplier or as a coordinator/supervisor. Availability8 risk covers cases where, during the operation of the asset(s), the responsibility of the non-government partner is called upon, because of insufficient management performance, resulting in a lower volume of services than was contractually agreed or in services not meeting the quality standards specified in the PPP contract. Therefore, the government bears the majority of the availability risk, when (i) the PPP contract does not provide for automatic and significant non-performance penalties to be applied in case of non-performance by the nongovernment partner or (ii) when such penalties are not systematically applied. Demand9 risk covers the variability of demand for a particular service, like number of road users or volume of waste disposal (higher or lower than expected when the PPP contract was signed) irrespective of the performance of the non-government partner. In other words, there is demand risk when a shift in demand cannot be directly linked to an inadequate quality of the services provided by the nongovernment partner but is the result from other factors, such as business cycles, new market trends, changes in final users' preferences or technological obsolescence. Therefore, the government bears the majority of demand risk when it is obliged to make a given level of payment to the non-government partner independently of the actual level of demand. However, because the assurance of this level of payment is normally provided through minimum revenue guarantee or guarantee of minimum demand (provided by the government or third parties), such provisions need careful analysis. |

In practice, few projects evidence a complete transfer of these risks from the public to the private sector. There is a large variety of explicit or implicit government support mechanisms that make projects more attractive to private investors and lenders. An assessment of these instruments and their impact on the statistical classification of the asset(s) is provided in chapter 3 below.

The conditions determining whether most of the project risk is transferred often differ between ESA 95 and national accounting standards i.e. between statistical and accounting treatments. Nevertheless, where national accounting standards require a 'risk and reward' test, the outcome of this analysis can usually be reasonably readily applied by national statistical offices for the purposes of ESA 95.

National Accounts reporting

Differences between Accounting and Statistical Treatment of PPPs

Summary table

| Accounting Treatment of PPPs | Statistical Treatment of PPPs |

What is its level of reporting (micro/macro) | Refers to reporting of PPP activities at a micro level | Refers to reporting of PPP activities at a macro level |

What is its rationale? | Good governance, accountability and sound financial management | Macroeconomic planning, international comparison, supervision and control |

What is its purpose? | Micro accountability | Macro accountability Fiscal risk control required by international commitments |

Where is it reported? | PPP activities are reported in central (or local/regional) government accounts | The statistical treatment of PPPs is reported in National Accounts |

How is it carried out? | PPP accounting treatment is carried out through the classification of the PPP assets either as central (or local/regional) government assets or non central government (or local/regional) assets | The statistical treatment of PPP is carried out by collecting aggregate data of PPP assets and classify these as either as government or non-government assets |

According to which rules are assets classified? | Assets are classified in accordance with accounting standards defined at the national level | The statistical treatment of PPPs is provided according to specific statistical rules defined at the international level. For the EU, these rules are the European System of Integrated Economic Accounts (ESA 95) |

Who does it? | The accounting treatment is carried out by accountants in the government department (or at the local or regional level) | Statistical treatment is carried out by national statistical offices (often with the involvement of representatives of national central banks and ministries of finance) and is reported to Eurostat |

_____________________________________________________________________

7 The Manual is available at http://epp.eurostat.ec.europa.eu/portal/page/portal/government_finance_statistics/introduction

8 The essence of an availability scheme is that government payment to a non-government partner is made only when the infrastructure service provided is made "available" (i.e. is provided according to a contractually specified standard).

9 The essence of a demand-based scheme is that the non-government partner bears the risk of a change in demand for the service provided.