2.3 The three-step process for determining the Eurostat treatment of PPPs

The Eurostat treatment of PPPs depends on the classification of the assets of individual PPP projects. This classification requires a three-step process:

(i) to distinguish PPPs from other long-term public private arrangements that have a different accounting and statistical treatment (e.g. design-build-operate or outsourcing contracts);

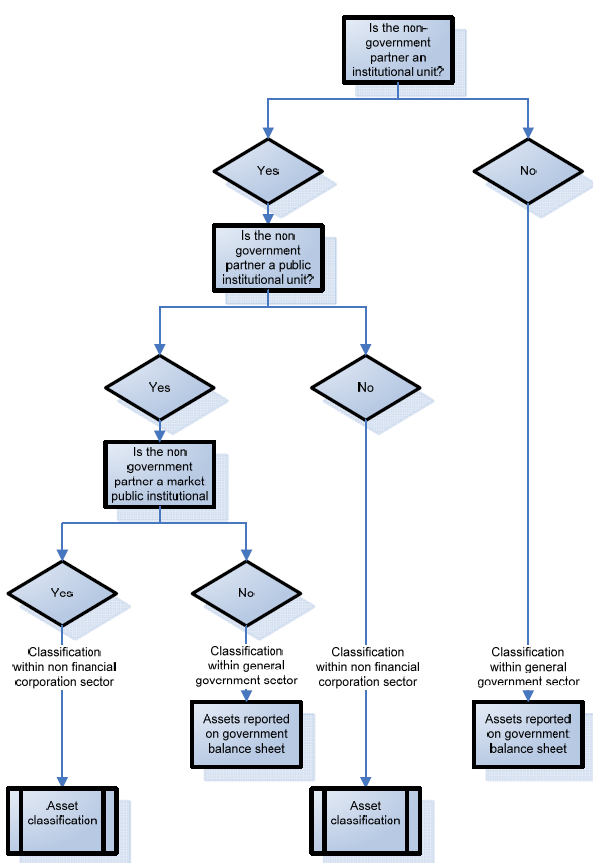

(ii) to determine if the partner unit developing the project is part of the general government. This determination is based on real economic flows, independently from any legal structure (the so-called "institutional sector classification" illustrated below);

(iii) to assess the risks borne by the public and the private partners. The asset classification determines which partner (government or nongovernment) is bearing most of the project risk such as to determine which partner has economic ownership of the assets involved in the PPP.

When the non-government partner does not consolidate its accounts with the government, asset classification needs to follow the "institutional sector classification". When the non-government partner does consolidate its accounts in the government accounts, asset classification is not required and total investment will be computed as government deficit and debt.

The "institutional sector classification" decision tree

(Note: a re-classification is possible if the non-government partner loses its autonomy of decision or becomes a non-market public unit.)