4.2.2 International Public Sector Accounting Standards (IPSAS) ED 43

As noted above, the guidance contained within IFRIC 12 applies only to the private sector partner. However, as a result of the publication of the standard, the International Public Sector Accounting Standards Board (IPSASB) has started a consultation process on the treatment of PPPs within the public sector. This led to the publication of a consultation paper in March 2008. In December 2009, a task force of the IPSASB developed an exposure draft "ED 43 Service Concession Arrangements: Grantor" (ED 43) which was published in February 2010.

The reasons for the production of ED 43 were the same as for the introduction of IFRIC 12. In addition, IPSASB noted that the lack of specific guidance on PPPs for the public sector had occasionally resulted in PPP assets being reported on neither the government nor non-government partner's balance sheet. This has been considered an incentive for the public sector to use PPPs as a means to fulfil their infrastructure needs while not recognizing the assets and related liabilities in their financial statements. This was deemed an inappropriate means of meeting fiscal targets.

The proposed international public sector accounting standard contained in IPSAS ED 43 addresses the issue as it is modelled on IFRIC 12. Indeed, it precisely mirrors the PPP accounting rules applicable to the private sector.

| Service Concession Agreement under IPSAS ED 43 A service concession arrangement typically involves an operator constructing or developing the asset used to provide the public service or upgrading an existing asset and operating and maintaining the asset for a specified period of time. The operator is compensated for its services over the period of the arrangement. The arrangement is governed by a binding arrangement that sets out performance standards, mechanisms for adjusting prices and arrangements for arbitrating disputes. The service concession arrangement is binding on the parties to the arrangement and obliges the operator to provide the public services on behalf of the public sector entity. |

IPSAS ED 43 addresses the government partner (grantor) accounting issues which correspond to the non-government partner (operator) accounting issues addressed in IFRIC 12. If IPSAS ED 43 were adopted, the symmetry between it and IFRIC 12 would significantly limit "off-off balance sheet" reporting. In other words, IPSAS ED 43's approach would require both the grantor and the operator to apply the same principles in reporting the asset underlying the PPP contract. IPSAS ED 43 would minimise the possibility of an asset being accounted for by neither (or both) parties12.

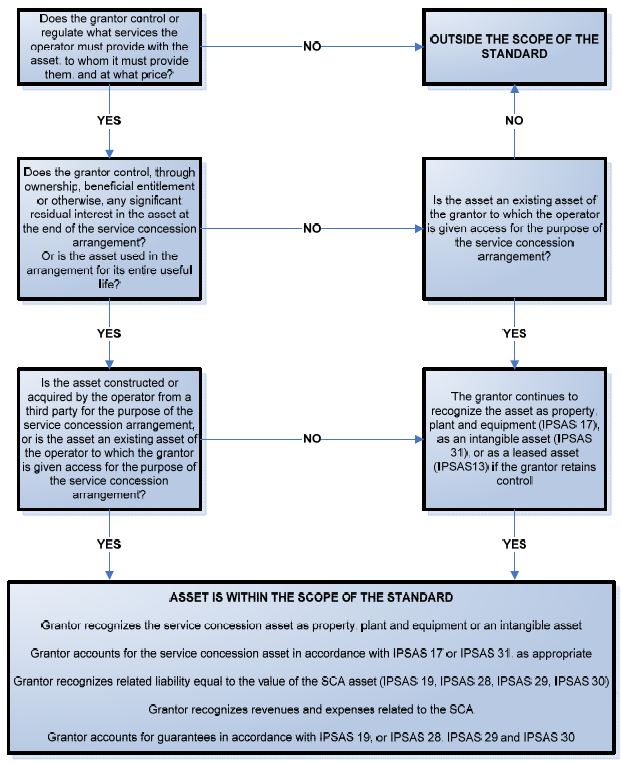

Like IFRIC 12, IPSAS ED 43 requires the reporting of PPP assets on the basis of a "control" criterion. A more detailed description of how IPSAS ED 43 works is provided in the diagram below.

Accounting framework for Service Concession Agreement

According to IPSAS ED 43

___________________________________________________________________

12 'Off-off balance sheet" reporting has occurred in a number of cases of PPP projects. This is a direct result of the application of different accounting standards by the public and private sectors. The logic of this is typically very difficult to explain to both politicians and the media.