Public Sector Comparator (PSC)

The PSC is estimated by first using the raw inputs (non-risk adjusted) that include capital costs, operating costs, and major or capital rehabilitation costs for the whole project term.20 With just these raw inputs the PSC represents a risk-free project outcome; however, every project has risk. As discussed earlier, in order to make the PSC more accurately reflect potential project outcomes, it must also be adjusted to include risk. The risk adjusted PSC, in turn, can then be appropriately compared with the risk-adjusted Shadow Bid.

Partnerships BC uses the extensive risk guidance developed for risk management and risk as it pertains to quantitative analysis discussed in detail in Section 4.2 and Appendix 3. Based on this approach, all the expected values of the risks-both construction and operating-are expressed as an NPC, and added to the NPC of the PSC.

In addition to an adjustment for risk to both the capital and OMR costs, additional adjustments are made as described in Section 4.

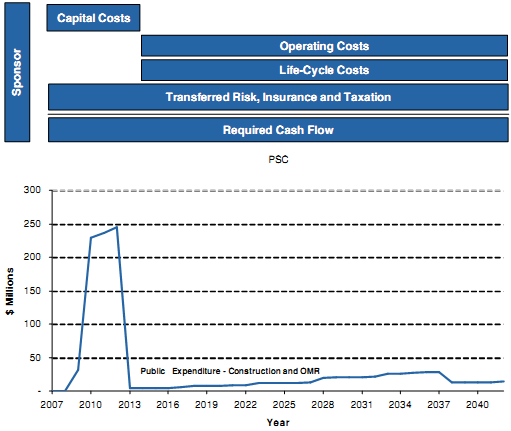

With these inputs, the PSC is constructed by compiling the costs to the owner of pursuing the project traditionally. Figure 2 below presents the corresponding cash flows from the owner's perspective. The line graph shows the profile of capital costs, combined with operating costs and life cycle costs over the time period considered for the project. The bars in the top portion of the diagram show the various components of the line graph below.

Figure 2: PSC Financial Model

_________________________________________________________________________________

20 Refer to Section 3.1 for more details on capital, operating, and rehabilitation costs.