3.3.2 Infrastructure Financing and Procurement Models

A number of infrastructure financing and procurement (IFP) models are available to facilitate the construction and refurbishment of public infrastructure assets. These models vary in the degree and manner of private-sector involvement and the level and type of risk they aim to transfer to the private sector. At least nine common IFP models can be identified. They are summarized in Figure 3.2 below.

Figure 3.2-IFP Models-Definitions

| Model | Description |

| Traditional Capital Procurement | Following a competitive bidding process, the design and building aspects of an infrastructure asset are contracted out to the private sector at a fixed price that must meet public-sector performance standards. The government or public institution retains ownership. The public sector retains responsibility for ongoing management of the initiative, or may contract out these responsibilities separately. The initiative is funded from general government revenues or debt. |

| Design-Build | This model is similar to traditional capital procurement except that the design and build functions are combined within a single private-sector entity. |

| Operation/ Maintenance Service/Licence | Public-sector entities enter into agreements with private-sector firms to operate and/or maintain public infrastructure or deliver public services. |

| Pooled Borrowing | The financing requirements of a group of borrowers are "pooled" together and financed through a special purpose entity. This allows the financing entity to raise funds in the capital markets in a much more efficient manner than individual borrowers would be able. |

| Finance | An initiative is funded directly by the private sector using mechanisms such as a bond issue by the public entity or a bank loan. |

| Lease | The government leases an infrastructure asset from the private sector. The arrangement could also involve an agreement for the private sector to operate the infrastructure asset. |

| Design-Build-Operate | The private sector designs, builds and operates a new facility under an outsourcing arrangement. Ownership of the infrastructure asset and responsibility for financing remains with the public sector. |

| Design-Build-Finance-Operate | The private sector designs, builds and finances a new asset, typically under a long-term concession agreement. The private sector then operates the asset during the term of the agreement. A long-term lease may be used, with the private sector transferring ownership of the infrastructure asset to the government or the transfer partner at the end of the lease. |

| Design-Build-Own-Operate* | The private sector designs, builds, finances, owns and operates an infrastructure asset indefinitely or for a fixed period. |

These models must be examined on a case-by-case basis guided by the principles for infrastructure renewal articulated by the government. Careful consideration must be given to the appropriate role of the private sector in delivering public infrastructure assets. Engaging the private sector is generally more successful when:

• significant opportunities exist for private-sector innovation in design, construction, service delivery and/or asset use;

• clearly definable and measurable output specifications (i.e., service objectives) can be established, which are suitable for payment on a services-delivered basis;

• a market for bidders can be identified or can be reasonably expected to develop;

• there is potential to transfer real risk to the private sector;

• the private-sector partner has an opportunity to generate non-government streams of revenue (e.g., charge for private access in off-hours); and/or

• initiatives of a similar nature have been successfully procured using a similar method.

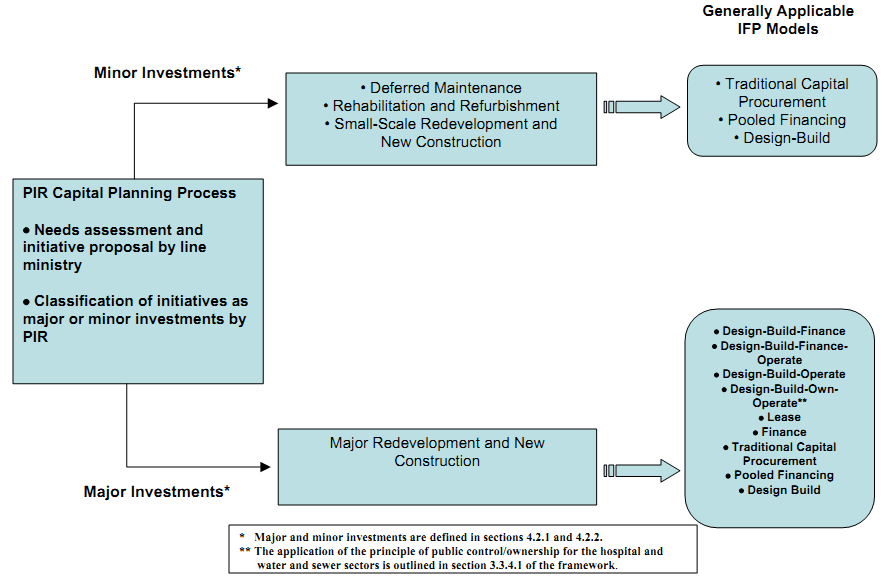

The decision tree below (Figure 3.3) provides guidance on the types of infrastructure investment that each model would seem to support based on the size and type of the infrastructure investment. For example, pooled financing would appear to be a useful approach for financing deferred maintenance, rehabilitation or refurbishment, whereas a design-build-finance-operate model would not. The design-build-operate model would seem to be more appropriate for large-scale redevelopment or new construction initiatives.

The criteria outlined in section 3.3.3 will help in determining which financing and procurement model is most appropriate for an infrastructure investment initiative and the role, if any, that the private sector should play in delivering the initiative.

Figure 3.3-Financing and Procurement Models-Applicability