4.5 Conclusion: PPPs provide greater commercial surety

In summary, based on our statistical analysis of data for 54 PPP and Traditional projects, we have found the following:

• Optimism cost bias -PPPs were much more likely to be concluded on budget, providing greater commercial surety to government and the community.

On average, PPPs have been found to be subject to a negligible degree of optimism cost bias. However, cost over-runs of $673 million were recorded during Stage 3 of the Traditional projects in our sample that had been contracted at $4.5 billion, and the dispersion of cost outcomes was much wider than for PPP projects.

• Optimism time bias - Larger

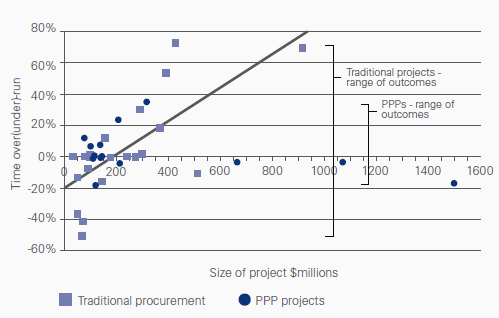

Traditional procurement projects tend to be completed well behind time, but smaller less complicated ones are generally completed on time.

In Stage 3, when the contractor largely controls the timing, PPPs have been found to be more timely on a value weighted basis compared with Traditional projects.

Table 4.4 PPP and traditional projects (%): value weighted time over-run

Table 4.4 PPP and traditional projects (%): value weighted time over-run

_____________________________________

Source: ACG/University of Melbourne

|

|

|

% Weighted Time over/ under-run |

|

Traditional |

25.6% |

|

|

|

13.2% |

|

|

Stage 1 |

Traditional |

28.8% |

|

|

13.3% |

|

|

Stage 2 |

Traditional |

8.9% |

|

|

16.5% |

|

|

Stage 3 |

Traditional |

23.5% |

|

|

-3.4% |

|

|

|

||

◀ Figure 4.2 Stage 3: traditional project optimism time bias by project size

______________________________________

Source: ACG/University of Melbourne