4.1 Credit Guarantee Finance

Credit guarantee financing (CGF) was introduced in the United Kingdom in 2003 to provide a multi-purpose mechanism for employing public debt capital to PPP projects. In a conventional PPP, the consortium arranges the equity and mezzanine capital requirement (for example, shareholder loans) and raises its debt requirement from the capital market.

To lower the cost of debt capital, the SPV will have the project assessed by a credit rating agency (the underlying rating) with a view to obtaining credit enhancement (credit risk insurance) from a monoline agency. For a fee, the SPV will secure an AAA credit rating from the insurer which lowers borrowing costs. The recent sub-prime credit crises has reduced the numbers of active monoline insurers in international and domestic capital markets and many of the major insurers no longer possess the important AAA credit rating.76 The higher cost of SPV debt over contracts of 20 and 30 years significantly impairs value for money outcomes.

The CGF approach has the state providing senior debt to the SPV supported by a monoline agency's AAA guarantee of the consortium's obligations. CGF was financed with an initial £1 billion of debt raised by HM Treasury in 2004. CGF was trialled with two health projects in 2004 (Leeds) and 2005 (Portsmouth). In the Leeds project, the consortium's financiers provided the credit guarantee and for the Portsmouth project, the guarantee was furnished by a monoline insurer. An assessment of both projects identified lifecycle interest cost savings to be in the range 8-16% of aggregate finance costs.

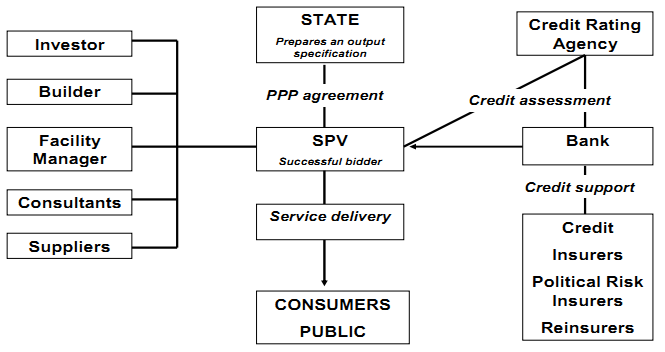

Diagram 3 PPP Contractual and Finance Arrangements

The nucleus of the transaction is the guarantee furnished by the consortium's bankers or a credit enhancement agency (monoline insurer) to the state as security for the loan. The objective of CGF is to reduce the consortium's cost of capital and thereby improve the long-run and overall value for money outcomes for the state. This arrangement is a departure from traditional project finance principles whereby senior debt is limited recourse and secured over underlying project assets. CGF is, in fact, full recourse debt and this does affect the traditional incentive mechanisms that are a feature of conventional project financings.77

The CGF modifies the underlying PPP transaction in a number of important ways. PPP transactions rely on a combination of incentives, regulatory and governance frameworks and, market discipline. Against this background, the effects of CGF are as follows:

1. CGF gives the state three roles in a PPP transaction - project origination, project finance and contract administration during the term of the contract. The multiple roles create contractual complexity and potential conflicts of interest. For example, a discretionary or disputed abatement of a unitary (or asset availability) payment by a contract administrator may impair the SPVs capacity to service debt leading to default and a call under the guarantee.78

2. The substitution of state for corporate debt effectively reduces the SPVs cost of capital. At 28th February, 5 year AAA bonds issued by the Commonwealth offered a yield of 3.73%, AAA bonds issued by T-Corp (NSW) 4.86% and AA corporate bonds 5.52%. 79 This suggests interest savings of 179bp and 66bp respectively. However, the benefit is reduced by direct and deadweight costs, and transaction costs. Additionally, for the state to assume transactional and guarantee risk, the interest rate should also recognise a credit risk premium notwithstanding an unconditional guarantee.80

3. Application of CGF requires Treasury to assume the role of an arm's length lending bank involving loan documentation and administration, legal and advisory fees, regulatory oversight and industry-specific technical knowledge and the agency costs involved.

4. CGF introduces another layer of contractual complexity into the PPP transaction which contributes to additional decision-making friction that will incur time and cost delays.

5. In the volatile market conditions of the past 18 months, a number of leading monoline insurers have received credit rating downgrades and several have withdrawn from the market altogether.81 In August 2008, only 18% of the domestic credit insurance market had held their Standard and Poor's AAA credit ratings. This suggests that the void will need to be filled by consortium members and/or domestic banks with associated guarantee fees and transaction costs that would offset the cost of debt savings. The underlying credit rating of PPP projects in Australia is BBB or investment grade reflecting project fundamentals and the credit strength of the principal contractors as a proxy for the likelihood of satisfactory project delivery. This raises the question of a shadow credit risk premium suggesting the impact of the CGF in prevailing market conditions may well be negligible.

6. PPP consortia are generally a collection of entities with different incentives and timing objectives. Few corporations plan much beyond 5 years and most for much less than that. Construction companies have an appetite for delivery risk but are averse to long-term equity holding positions. Portfolio investors prefer stable, long-term revenue streams which favour projects with mature income and expense characteristics and a low risk profile. SPV members may migrate across different industry sectors attracted by diversification, higher returns or greener pastures. The dynamics of the listed market favour flexibility. The CGF model with its long term debt obligations inhibits this flexibility, which may reduce depth in bid markets.

7. PPPs are an incomplete contract - commercial and financial settings change, risk profiles are dynamic, opportunity may arise for renegotiation of parts of the agreement, real and embedded options may be exercised, and there will be ongoing changes to the marginal return on investment and underlying investment economics. Long-term debt arrangements may inhibit sponsor flexibility.

8. Economies of scale suggest that for the CGT program to derive large scale benefits for the state and mitigate unsystematic risk, it would need to be applied to a large number of industry-specific projects.82

The CGF model provides a substitute for private debt and therefore maintains the important incentive framework for the members of the SPV to perform under the contract. However, it does away with the independent private financier and removes an important performance monitoring and governance check on the SPV. A bank lender advancing senior debt to a SPV holds a limited recourse asset under a loan agreement that gives the lender a step-in right in the event of default. The lender assumes an independent financial monitoring role with a view to minimising non compliance with KPIs that result in abatements, penalties and reduction in debt servicing capacity. Additionally, private lenders bring market disciplines, know-how, financial risk-management expertise and industry experience to the role and apply a further level of governance. The CGF replaces the bank with financial institutions that don't bring the same commercial acumen or experience to the role. A passive debt guarantor and a Treasury Corporation will be required to deal with performance monitoring, loan administration, a dynamic risk environment, financial risk management and the financial economics of a long-term PPP. These activities are not always central or core competencies.

The CGF model is better suited to the European SPV structure than the variation employed in Australia. European SPVs are generally contractor-led and employ long-term project finance arrangements with embedded refinance options. In Australia, SPVs are often led by financial intermediaries who provide the capital underwritings for bids. CGF was not used after the Leeds and Portsmouth hospital PFI contracts although comprehensive guidance and standard form documentation has been put in place.83 There is no commitment to proceed further with CGF although it remains an option for the future.

__________________________________________________________________________________

76 Regan 2008a, p. 18.

77 The finance is full recourse to the guarantor. This also takes place with credit enhancement of conventional project financing arrangements and the credit insurer is required to meet shortfalls in principal and interest. Nevertheless, under CGF, Treasury requires the unconditional guarantee of repayment in the event of default (HM Treasury 2005).

78 NAO 2003b.

79 RBA 2009.

80 Corporate AAA debt attracts a higher spread than state debt and a corporation cannot have a credit rating superior to that of the sovereign government.

81 Regan 2008.

82 A further criticism of the CGF model is that it doesn't offer the incentive mechanism available with conventional PPPs whereby senior debt providers possess a right of subrogation in the event of default and possess incentives to negotiate a commercial and operational rescue of the project whilst maintaining service delivery. Under CGF, the incentives are less clear.

83 HM Treasury 2003.