4.2 The Supported Debt Model

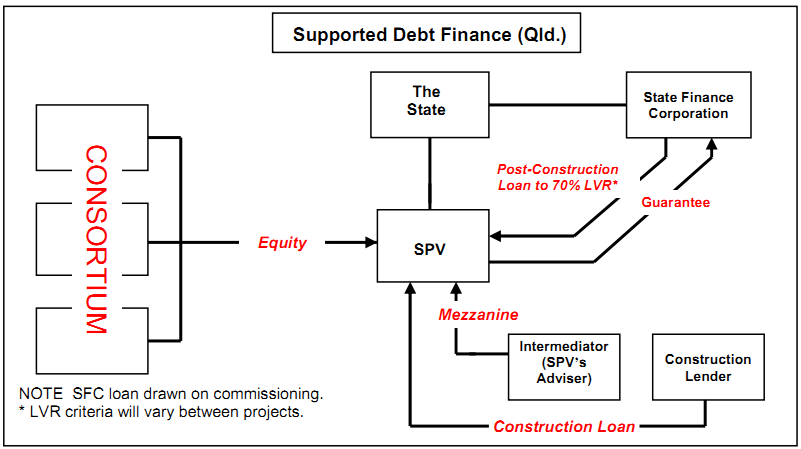

In 2008-09, the Queensland Government conducted a pilot program for a PPP in the education sector using a hybrid variation of CGF described as the supported debt model (SDM). The SDM has several distinguishing characteristics:

1. The SPV arranges private construction finance

2. When the asset is commissioned, the state provides a long-term finance facility to repay construction finance

3. The level of state debt employed is calculated using a formula that equates to a minimum asset value (or recoverable amount) in the event of consortium default. This may be expressed as a percentage of on-completion value. The state assumes the role of limited-recourse lender although the arrangement does not rule out a requirement for full and partial guarantees.

4. The state holds the senior debt position. The SPV will raise additional subordinated debt and equity capital from private sources. The SDM preserves traditional ex ante incentives and does not require credit enhancement or supporting private guarantees.

5. The lower cost of state debt reduces the cost of capital for the SPV and improves value for money lifecycle finance costs which should be reflected in an improved value for money outcome for the state.

The SDM takes advantage of the significant change in risk profile that accompanies the commissioning of a PPP project. The SDM is calculated against a notional risk-free minimum value for the project against which the state can make debt finance available to the project at cost. The SDM has three distinctive characteristics:

1. SDM financing is attractive from a value for money perspective, particularly given the recent increased spreads for private debt following the global financial crisis and it avoids the costly requirement for credit insurance.

2. The SDM model gives rise to high transactional costs during the early stages of the project although these may decline when the project reaches operational maturity. Overall contractual friction should be less for SDM than CGF with lower transaction and agency costs.

SDM has parallels with conventional project finance but shares little in common with the short to medium-term corporate finance employed in most Australian PPPs. An implication of the model that may adversely affect improved value for money outcomes is the need for privately sourced junior and mezzanine debt or equity capital to bridge the gap between the recoverable amount and the higher level of senior and subordinated debt usually sourced from banks. Subordinated debt carries higher risk premium.

Recent research suggests that the average state contribution to PPP debt capitalisation will be around 65-70% of capital requirement suggesting a mezzanine/junior debt participation of around 15-20% in addition to the equity contribution. The overall cost of debt will be determined on a project basis and particularly on the underlying credit strength of the underlying transaction and the quality and experience of the consortium. The use of higher levels of private mezzanine/subordinated debt and equity capital in prevailing market conditions may increase the SPV's cost of capital and offset part of the SDM's savings in lower debt cost without the relief offered by revaluation and refinancing. However, when capital is difficult to source, this is less of a consideration provided the VFM outcome remains positive.

The break-even point for SDM is narrow and estimates suggest that this may occur when average private debt spreads exceed 500 basis points.84 Depending on the unsystematic risk profile of the underlying transaction, this is most likely to occur in prevailing market conditions. SDM may raise the sponsor's overall cost of capital and this could offset a significant part of the cost savings achieved with lower cost senior state debt.

A second issue is the consortium's lack of flexibility. The SDM removes the short and medium term revaluation and refinancing gains of the Australian approach to long-term PPP contracts. PPPs are long-term incomplete contracts frequently containing embedded options to deal with changed operational or broader network conditions. Revaluation enables early-stage risk-taking equity investors to exit the project and sell down to more risk-averse fund managers and institutional investors.85

Refinancing has several important advantages for mature projects - it permits an increase in senior debt (thereby reducing more costly subordinated debt and overall cost of capital), and facilitates higher leverage and a withdrawal/return to equity. Refinancing gains are shared with the state under Australian PPP guidelines.

Diagram 4

A third issue is the additional administrative cost that SDM imposes on the state. As a secured lender to the project, the lending agency will need to replicate private banking credit assessment and loan administration roles. This will add significantly to transaction and agency costs and in the nature of government, adds a layer of procedural and governance friction.

The SDM has only been used for the South East Queensland Regional School project at this time.

__________________________________________________________________________________

84 McKenzie 2008.

85 Tapper and Regan 2007.