1.1 What is a PFP and what is the purpose of these Guidelines?

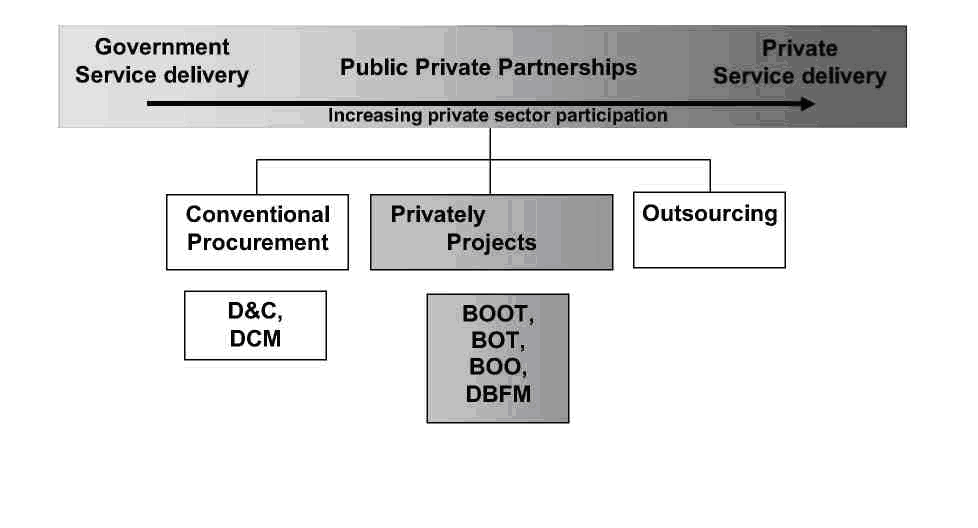

The New South Wales Government engages the private sector in public service delivery in many ways, which may be broadly termed public private partnerships (PPPs). PFPs, the subject of these Guidelines, are one type of PPP.

PFPs create new infrastructure assets and deliver associated services for a specified period through private sector financing and ownership control. Private financing and ownership are features of projects covered by these Guidelines, distinguishing them from outsourcing of services to the private sector or infrastructure procured by conventional methods such as design and construct contracts.

The principal features of a PFP are:

• A service normally provided to the public by Government involving the creation of an asset through private sector financing and ownership control

• A contribution by Government through land, capital works, risk sharing, revenue diversion or other supporting mechanisms.2

A PFP entails both the creation of a new asset and the delivery of some services associated with the asset for a defined, but typically very long, period. The balance of total project value between the asset creation and ongoing service delivery components may vary greatly from project to project.

In a capital-intensive project, such as a toll road, asset creation is likely to dominate. In projects such as schools, courthouses and hospitals, the long-term service delivery component is likely to be larger, even with the public sector providing core services.

PFPs are typically complex and involve high capital costs, lengthy contract periods involving long-term obligations and a sharing of risks and rewards between the private and public sectors.

Because PFPs require careful consideration, the Budget Committee of Cabinet (BCC) will review and progressively approve the projects at each phase of their development.3 Applicable environmental planning approvals will also be required in accordance with the EP&A Act.

PPPs can make a very valuable contribution to the delivery of public services in NSW and are therefore encouraged, where appropriate, by Government. The challenge to the public and private sectors is to determine the most effective and efficient means of service delivery in an arrangement that is beneficial to both sectors as well as to users and taxpayers.

All procurement by agencies other than State-owned corporations, whether conventional procurement, PFPs or outsourcing, are subject to the NSW Government Procurement Policy4 and its associated guideline documents.

State-owned corporations are subject to the Guidelines for Assessment of Projects of State Significance5 and the Reporting and Monitoring Policy for Government Businesses6. In addition, all agencies procuring PFPs are subject to these Working with Government Guidelines.

This means that in the first instance, all PFPs must be consistent with an agency’s Asset Strategy and should have undergone an economic appraisal.

The reason for having a distinct set of guidelines for PFPs is that PFPs raise unique issues and risks for Government.

These risks stem from private sector financing and ownership and the very long-term nature of the commitments involved.

Figure 1.1 illustrates the relationship between PPPs and other forms of procurement including PFPs.

Figure 1.1. Public service delivery spectrum

_____________________________________________________________________________

2 See also Public Authorities (Financial Arrangements) Act 1987, especially Section 5A.

3 Although PFPs will normally be large projects or bundles of smaller projects with a total contract value of $50M

or more, occasionally a smaller project may be developed as a PFP. For PFPs costing $5M or less in total, the

BCC has delegated approval authority to the Treasurer. Refer to Treasury Circular 98/5, available at

http://www.treasury.nsw.gov.au/pubs/98tcirc/tc_9805.htm.

4 Available at http://www.treasury.nsw.gov. au/procurement/procure-intro.htm.

5 Available at: http://www.treasury.nsw.gov.au/pubs/tpp2002/tpp02-4.pdf

6 Available at: http://www.treasury.nsw.gov.au/pubs/tpp2005/tpp05-2.pdf