Reporting

Financial reporting. Chilean generally accepted accounting principles, which are accrual-based but not as developed as International Financial Reporting Standards, put some but not all PPPs on the government's balance sheet. Recently, for example, jails and airports were treated as public projects for accounting purposes, but roads were not. The Chilean government may adopt International Public Sector Accounting Standards (which are based on IFRS). Whether and when it does will depend on the adoption, outside government, of IFRS.

Financial statistics. However, for the purposes of the fiscal rule, the accounting that matters is prepared, roughly speaking, according to the IMF's Government Finance Statistics Manual 2001. The IMF's manual provides for accrual accounting that generally requires public investments to be expensed over their lifetime, not as they are constructed. In Chile, however, public investments in physical assets are still expensed during construction. This means that public investment in a toll road would immediately increase government spending for the purposes of calculating compliance with the fiscal rule. By contrast, as the statistics are actually compiled in Chile, concessions have no immediate effect on government spending for the purposes of the fiscal rule.

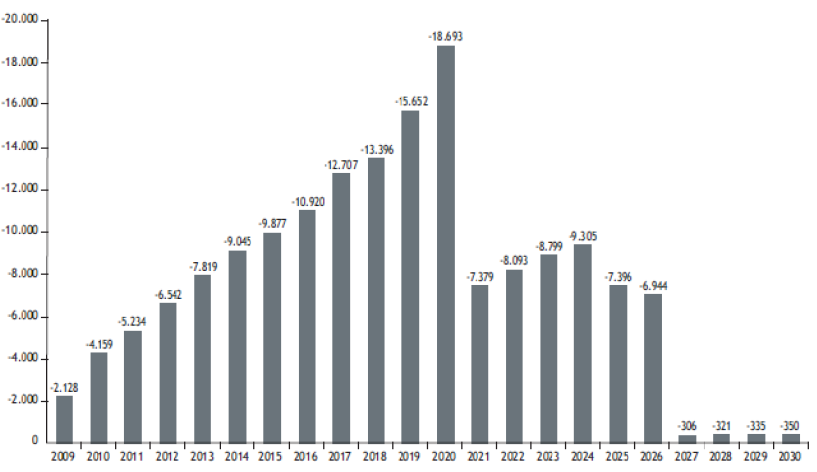

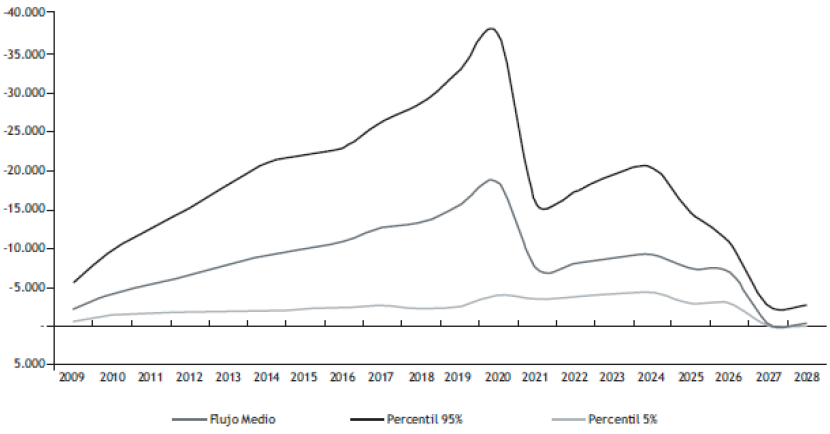

Other reporting. The government prepares two other reports that provide a great deal of information on the fiscal costs and risks of concessions. The first is an annual report on public finances (Government of Chile 2008a). The second is an annual report on contingent liabilities (Government of Chile 2008b). The report on public finances gives an estimate of the most the government could spend on revenue guarantees and an estimate of the net present value of the guarantees and revenue-sharing arrangement (Table 4). The report also estimates the present value of committed subsidies and availability payments. The report on contingent liabilities discusses not only expected cash flows from revenue guarantees but also the variability of those cash flows (Figure 2).

Figure 2 Forecast payments from Chilean revenue guarantees

(million pesos)

A. Expected payments

B. The 5th, 50th, and 95th percentiles of the forecast distributions

Source: Government of Chile (2008b).

Note: A decimal point is used in Spanish where a comma would be used in English, so that 5.000 means five thousand. "Flujo medio" is the median (50th percentile) of the estimated probability distributions of cash flows. The other lines are the 5th and 95th percentiles of the estimated distributions. The peso-US dollar exchange rate was 588 on 27 April 2009. So, for example, 40 million pesos, the rough peak of the 95th percentile around 2019, is about $70 million.