2. Failure to Realize Value for Money

When you combine the higher borrowing costs of private financing with the often higher transaction costs—and subsequent monitoring costs—of engaging in these kinds of deals, the taxpayers end up paying far more than they would have under more traditional public financing.

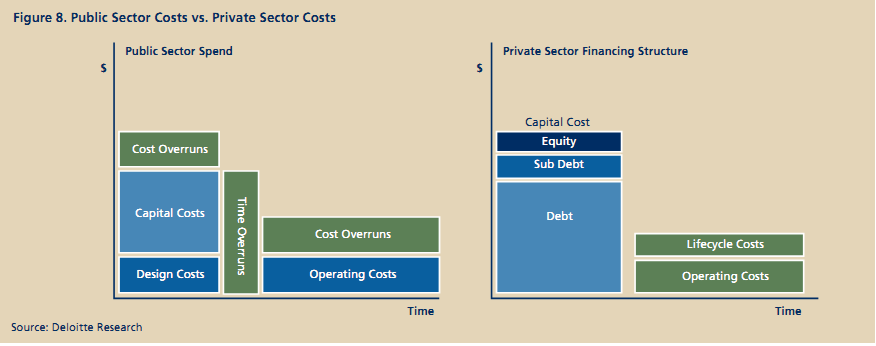

The issue of value for money should be an important feature of any public infrastructure project, though it gets more emphasis with PPPs. Value for money is based on the theory that the private sector brings in benefits and efficiencies that outweigh its higher borrowing costs. In analyzing value for money, it must be recognized that lowest price does not always mean best value. Value for money is a function of, among other things, price, quality, and the degree of risk transfer. UK government officials consistently rate PPPs as a good value for money. In a survey of 98 projects by the UK National Audit Office in 2001, for example, 81 percent of the public authorities said they were achieving satisfactory or better value for money from their PFI contracts, while only 4 percent described value for money as "poor." 70 A more recent survey of Scottish local government authorities made similar findings.71 Last, conventional procurement has resulted in very poor value for money, thanks to cost overruns, delays, and so on.

Several factors contribute to value for money, but primary among them is efficient risk allocation. Risk allocation is based on the premise that risk should be transferred to the party that is best suited to manage it. Optimal risk allocation leads to reduced cost associated with risk, which in turn leads to better value for money.

Evidence supports the view that PPPs transfer construction and maintenance risk to the private sector more effectively than traditional methods and is likely to deliver value for money where competition is strong and the projects are large. A review of eight Partnerships Victoria projects found a weighted average savings of 9 percent against the risk-adjusted Public Sector Comparator.72 In the case of smaller projects, "bundling" helps to spread procurement costs across several discrete projects.73