2.1 Accelerated Delivery

Accelerated Delivery refers to the benefits of having an asset and related services available earlier than otherwise would be the case. For instance, having a road, school or hospital delivered earlier means that society can enjoy the expected socio-economic benefits that come from transport, education and health services earlier. The value of Accelerated Delivery therefore is a function of how much more quickly services commence, and the benefits that come with these services.

It is helpful to distinguish two types of Accelerated Delivery: on-time delivery (where services start at their planned date) and earlier investment (service delivery commences earlier than would otherwise have been possible). PPPs can accelerate the delivery of an infrastructure and related services in two main ways:

∙ Better on-time construction performance: This is largely a result of the financial incentives incorporated into the terms of PPP contracts. These incentives apply to equity investors, lenders and contractors. The principle of "no service - no payment" ensures that the private sector is heavily incentivised to deliver to time (even where the private partner may have to absorb additional costs in the process)4. In practice, much of the project financial and technical due diligence carried out before contract signature is focused on ensuring the best possible conditions for on-time delivery of the infrastructure. PPPs impose a structure and a set of clearly defined and agreed timescales. PPP contracts also provide clear mechanisms for dealing with variants and delay events;

∙ Earlier delivery of a planned capital investment programme through a PPP: PPPs which involve the use of private finance can provide an important complementary, and additional, source of capital to traditional budgetary funds. This, in itself, can help to accelerate investment programmes. But in addition, the long term commitments that governments are forced to make under PPP contracts can help to focus the public sector's attention on more rational, long term capital planning. This, in turn, may allow the private sector to plan and deliver more coherent infrastructure programmes5.

In order to incorporate a valuation of Accelerated Delivery in a VfM analysis it is necessary:

∙ to explain how and why a PPP may result in earlier availability of infrastructure;

∙ to identify, quantify and, where possible, value the resulting NFBs which are available earlier.

The evidence regarding "on time" delivery of PPPs and programme investments referenced in this paper may be helpful in respect to the former. The issue of valuing NFBs has been addressed by the MAPPP6 in France using the method explained in Box 2 below.

Box 2 - New approaches to measuring Accelerated Delivery: the MAPPP approach

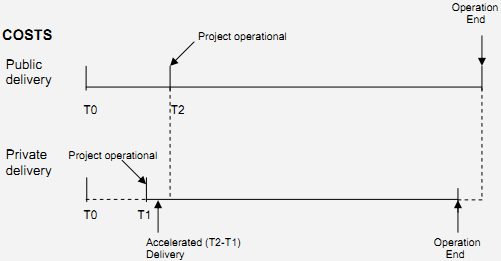

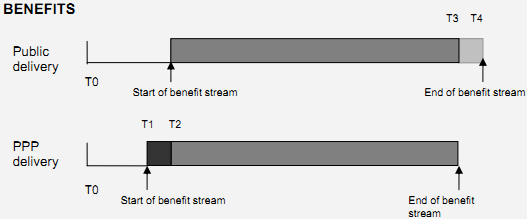

| MAPPP has developed an interesting approach towards measuring the value of Accelerated Benefits which we present below with a number of simplifying assumptions. Let us consider a large schools project, which if delivered by the public sector will cost €140,000,000 in net present cost terms. The same project if delivered by PPP will cost €150,000,000 in net present cost terms. If delivered by PPP the infrastructure will be operational in 3 years, whereas under public sector delivery it will take 5 years. Let us assume that once built, the infrastructure has an asset life of 30 years with no residual value at this point, and that at this point the PPP contract ends. Can we justify the PPP option even though it costs and additional €10,000,000? Put differently, is Accelerated Delivery worth an additional €10,000,000? The diagram below outlines the timelines of the cost and benefit streams associated with the project.

An innovation in the MAPPP approach is the following: If the political willingness to pay is equal to €140,000,000 for a project that becomes operational in 5 years, then the net present benefits of the project is at least equal to €140,000,000, otherwise the project would not go ahead in the first place. By applying the public sector's discount rate we can estimate the value of bringing these benefits forward by 2 years. This means calculating the difference between the present value of earlier benefits under PPP (between T1 and T2) and later benefits under conventional procurement (between T3 and T4). Let us assume the social discount rate for this project is 4% per year. The estimated value of accelerated delivery can then be calculated as: €140,000,000 (1+0.04)² - €140,000,000 = €11,424,000 Given that the value of additional benefits from PPP (€11,424,000) is greater than the additional costs (€10,000,000), the PPP option is justified on efficiency grounds. |

The Generic Benefits Matrix 1 which follows helps identify some of the potential additional NFBs associated with Accelerated Delivery under PPPs.

Generic Benefits Matrix 1 - Accelerated Delivery

| PPP feature | Sub-category | Examples | Usually included in PSC test? | Potential NFBs | Can they be quantified? | Can they be valued? | Potential approaches |

| Accelerated Delivery | Earlier investment and delivery7

| Hospital, school, road, etc. delivered earlier. Results in earlier (and therefore increased) output of public services (e.g. healthcare, education, transport) | No | Yes. Accelerated socio-economic benefits during the early delivery period | Yes. At a minimum we can quantify how much earlier the PPP should deliver compared to alternative (e.g. one year, two years). | Easier to estimate the value of Accelerated Delivery benefits where a cost-benefit analysis has been conducted. Cost benefit analysis methodology is more reliable for economic infrastructure (particularly traffic) where good estimates of valuation of time savings, accident prevention, congestion reduction already exist8, as opposed to social infrastructure, where benefits are less tangible. | Where a full cost-benefit analysis has been conducted (i.e. where the value of benefits is directly measured), the value of Accelerated Delivery benefits can be readily calculated by applying the appropriate discount rate. Where a cost-benefit analysis has not been conducted the value of Accelerated Delivery benefits can be estimated based on the political "willingness to pay" (see Box 2). |

| On-time delivery9 | Risk of delay probably in PSC test but social costs of delay / benefit of on-time delivery are not |

___________________________________________________________________________

4 Extensive work outlining on-time delivery in PPP construction exists: see for instance NAO, PFI: Construction Performance (2003), NAO, PFI: Construction Performance (2009) and Standard and Poor's, The Anatomy of Construction Risk: Lessons from a Millennium of PPP Experience (2007).

5 For example, the 'Building Schools for the Future' or 'National Health Service Local Infrastructure Finance Trusts (NHS LIFT)' programmes in the UK.

6 Mission d'appui à la réalisation des contrats de partenariat.

7 Evidence / examples cited above: see NAO 'Department of Health - Innovation in the NHS: Local Improvement Finance Trusts' (2005) and 'Building Schools for the Future'.

8 The following sources provide a good starting point for applied cost benefit analysis. They do not attempt to incorporate the benefits associated with any procurement type but rather NFBs per se. Where we have an indication of NFBs in a cost benefit analysis, however, we can then estimate the value of accelerated benefits (as outlined in the potential approaches above) should they exist. See DG Regio, Guide to Cost Benefit Analysis of Infrastructure Projects (2008) for an overview of approaches and estimates. See also HEATCO, Developing Harmonised European Approaches for Transport Costing and Project Assessment, Proposal for Harmonised Guidelines (2006) which provides extensive data for valuing socio-economic impacts.

9 Evidence / examples: Construction performance: NAO (2003) op. cit.; NAO (2009) op cit.; Standard and Poors (2007) op cit.; EIB, Public Private Partnerships, (2009) Unpublished; University of Melbourne , National PPP Forum, Benchmarking Study, Phase II (2008).