2.2 Who is the private party?

Throughout this document, the term 'private party' is used to describe the private sector entity with which government contracts. This may be a 'special purpose vehicle' created specifically for the purposes of the project. The private party is not limited to this form, however, and can be set up under a number of structures including; as a subsidiary of an existing company, a joint venture or a trust structure. Behind the private party there may be a number of private sector parties (the consortium) who will be seeking to have their interests represented through the private party. Government needs to appreciate each of these groups' interests when negotiating its position.

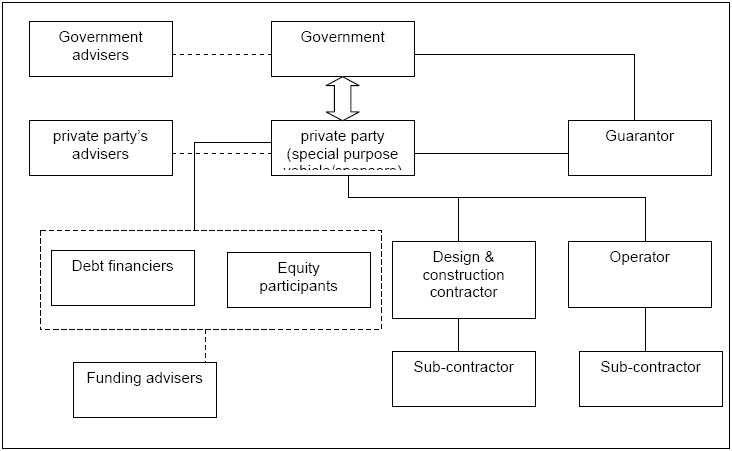

In the case of a privately financed public private partnership project, a consortium is likely to include debt financiers (often in a syndicate arranged through a bank), equity investors/sponsors (who invest in the fortunes of the project and are therefore exposed to both the 'upside' and 'downside' risks), a design and/or construction contractor, and the operator. Figure 1 shows the configuration of a typical consortium and its relationship with government and government's advisers.

Figure 1 Typical private sector consortium

When undertaking public private partnership projects, there is a strong preference that government contract with a single party who is fully accountable for all contracted services. From the government's point of view, risk allocation is most effective where there is a whole of life contract with a single private party. This ensures the private party the strongest possible incentive to ensure that the design and construction phase converts into a highly effective operation. However, as illustrated in Figure 2.1, the private party is possibly complex with differing interests that may underlie its objectives in negotiation.

The configuration represented in Figure 1 does not apply to all consortia. For some smaller projects, a simpler consortium structure may apply. In such cases, it is common for the sponsor to be a large company that finances the project on its balance sheet. The sponsor may refinance the project upon a successful commissioning, and an special purpose vehicle may be established at that stage.