Patronage projections needed more scrutiny

As Exhibit 2.2 shows, two out of the three private sector bidders thought the project, as put to tender, was not financially viable without significant government funding. This should have prompted greater scrutiny and challenge of the patronage projections underlying CCM's bids, particularly its winning bid.

In fact, the differences in patronage projections between CCM and the two other bidders were so significant that the assessment panel should have seriously questioned the viability of all the CCM bids.

On the surface, the risk of over-estimating patronage appears to lie only with the bidder. We will analyse later how getting the patronage wrong impacts adversely on government and on tunnel users.

We compared the patronage projections for 2006 and 2016 for the short-listed conforming bids and the RTA's benchmark for the main tunnel, the SJYC exit tunnel, and the combination of both.

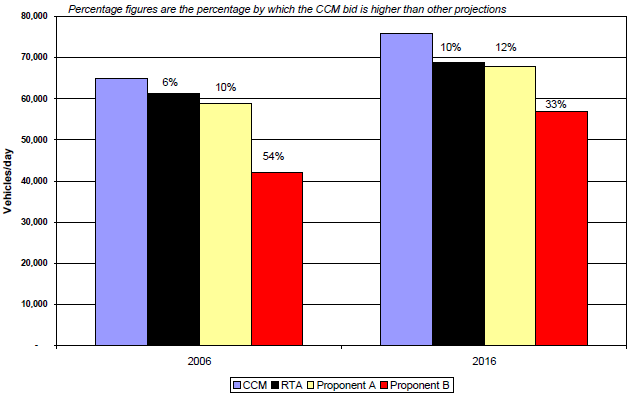

As Exhibit 2.3a shows:

■ for 2006, CCM's patronage projections for the main tunnel were six per cent higher than the benchmark, ten per cent higher than proponent A, and 54 per cent higher than proponent B

■ for 2016, at nearly ten years of operation, CCM's patronage projections for the main tunnel were ten per cent higher than the benchmark, 12 per cent higher than proponent A, and 33 per cent higher than proponent B.

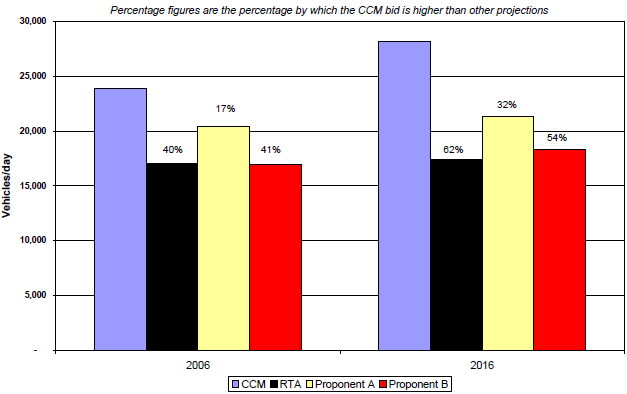

Exhibit 2.3b shows that the patronage projections for the SJYC exit tunnel were even more divergent:

■ for 2006, CCM's patronage projections were 40 per cent higher than the benchmark, 17 per cent higher than proponent A, and 41 per cent higher than proponent B

■ for 2016, at nearly ten years of operation, CCM's patronage projections were 62 per cent higher than the benchmark, 32 per cent higher than proponent A, and 54 per cent higher than proponent B.

Exhibit 2.3a: Main tunnel. Comparison of patronage projections by the RTA and in the conforming bids |

|

Exhibit 2.3b: Sir John Young Crescent Exit tunnel. Comparison of patronage projections by the RTA and in the conforming bids |

|

Source: CCT Evaluation of Proposals report |

Adding the main and short exit tunnel projections, the differences for the conforming bids are larger. CCM's bid was:

■ 13 percent higher than the RTA benchmark for 2006, and 21 percent higher for 2016

■ 12 percent higher than Proponent A for 2006, and 17 percent higher for 2016

■ 50 percent higher than Proponent B for 2006, and 38 percent higher for 2016.

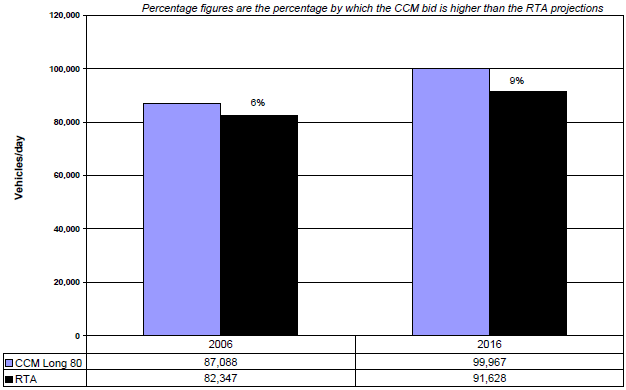

Exhibit 2.4 compares CCM's patronage projections for its winning 'Long 80' bid to the RTA's revised projections for the longer tunnel:

■ for 2006, CCM's figures were still six percent higher than the RTA

■ for 2016, CCM projections were still nine percent higher than the RTA.

Exhibit 2.4: CCM's patronage projections for the 'Long 80' compared with the revised projections of the Public Sector Comparator - 2006 and 2016 |

|

Source: Information provided by the RTA to the Audit Office |

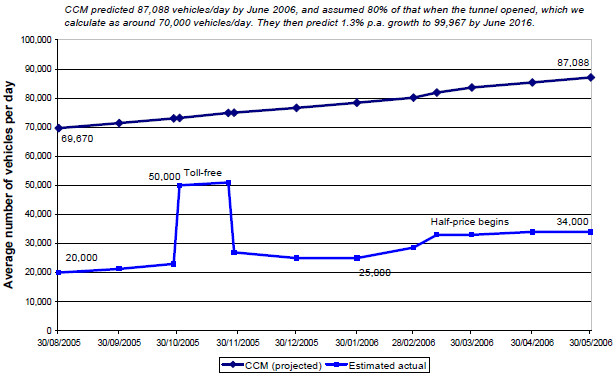

It is still early to judge the longer-term accuracy of projections. We show in Exhibit 2.5 that since the opening of the tunnel, an average of fewer than 25,000 vehicles per day have used the tunnel while the toll has been at full price. This is less than a third of CCM's forecast and of the patronage the RTA predicted.

All major transport projects go through a 'ramp-up period'. This is the time it takes potential users to get to know the routes, and make the decision to use the new project as their best alternative. It is commonly estimated as between 18 months and three years.

Exhibit 2.5 shows that even during the toll-free and half-price periods, the increase in patronage has been well below predictions. It appears that the reluctance to use the tunnel extends well beyond unfamiliarity, and indicates a pattern of resistance to using the CCT. Because of this, we do not think that the CCT is experiencing a standard ramp-up period.

The company could make further changes to the toll levels and the way it markets the project. These might lead to increases in traffic volumes.

|

Exhibit 2.5: Estimated actual patronage compared to CCM's projections - nine months |

|

|

|

Source: Audit Office research. Information on CCM projected patronage obtained from RTA documents. Estimated actual patronage based on research plus CCM statements where available. |

The approach taken in this type of privately financed projects is that the operator bears the patronage risk. That is, if fewer cars use the tunnel, CCM will make less money, but the Government will not lose any. This approach presents two significant risks to government.